Trump-Xi Trade Truce Delivers Global Risk Relief Despite Manufacturing Weakness | Links: [1], [2], [3]

The Trump-Xi meeting delivered a comprehensive trade truce that markets are calling "remarkable," featuring China's commitment to purchase 12 million tonnes of US soybeans this season plus 25 million tonnes annually for three years, suspension of battery export controls, and delays to rare earth restrictions. The agreement emerges as China's manufacturing PMI dropped to a six-month low of 49.0 in October, missing forecasts and marking the seventh consecutive month of contraction with export orders particularly weak. Despite this economic backdrop, the deal represents tactical de-escalation between the world's two largest economies, with Xi securing supply chain stability commitments from Asian partners at APEC whilst Trump's absence allows Chinese influence to expand in Pacific trade discussions. The truce reduces geopolitical risk premiums across emerging markets and commodity-sensitive sectors, particularly benefiting agricultural futures and rare earth miners, though underlying Chinese weakness may limit the upside for global growth expectations.

Global Central Banks Signal End of Easing Cycle Amid Policy Divergence | Links: [4], [5], [6]

The Federal Reserve delivered its expected 25bp cut but Chair Powell explicitly warned December action was "not a foregone conclusion," whilst Treasury Secretary Bessent criticised the Fed as "stuck in the past" and signalled potential institutional overhaul. This hawkish pivot extends globally: the ECB held rates at 2% with President Lagarde expressing confidence in economic resilience, reducing market pricing for further cuts from 50% to 40%. In Asia, the BoJ maintained its tightening bias with Governor Ueda signalling potential December or January hikes as Tokyo core inflation accelerated to 2.8%. This synchronised shift from the post-pandemic easing era represents a fundamental change in global monetary policy, with major central banks converging on restrictive stances despite varying economic conditions. The policy divergence creates significant cross-asset implications: dollar strength pressures emerging market currencies, higher real rates challenge equity valuations, and reduced accommodation tightens global liquidity conditions across regions.

Emerging Markets Extend Historic Bull Run Despite Central Bank Hawkishness | Links: [7], [8], [9]

Emerging market stocks posted their tenth consecutive monthly gain—the first occurrence since 1993—despite central bank policy tightening and dollar strength. The historic streak reflects structural shifts in global capital flows driven by AI demand for semiconductors and materials, China's manufacturing base diversification, and relative valuation attractiveness compared to developed markets. However, a troubling development for portfolio managers: developed and emerging market currencies now move in tandem, breaking traditional diversification benefits and highlighting how geopolitical risks have fundamentally reshaped correlation structures. Currency pressures remain intense, with the Indian rupee approaching record lows against the dollar whilst the yen hit eight-month lows near intervention levels at 154.45, prompting Japanese authorities to warn against excessive volatility. The breakdown of traditional EM-DM correlations challenges conventional risk models and hedging strategies, requiring reassessment of diversification assumptions even as EM equities demonstrate remarkable resilience.

Big Tech AI Spending Sparks Investor Scrutiny Despite Strong Fundamentals | Links: [10], [11], [12]

Meta suffered its worst trading day in three years with shares plunging 11% despite beating Q3 estimates, as the company announced aggressive AI spending plans and issued a $30 billion bond offering to fund infrastructure expansion. The brutal market reaction reflects broader investor concerns over AI investment returns, with trillion-dollar valuations now commanding intense scrutiny over capital allocation decisions. Yet outcomes within the technology ecosystem remain divergent: Amazon's AWS showed acceleration to 20.2% growth whilst Apple delivered strong iPhone 17 guidance, demonstrating selective strength beneath sector-wide AI spending concerns. NVIDIA's approach to $5 trillion valuation alongside plans to reindustrialise America highlights the sector's dual role as both growth driver and potential bubble risk, with market cap-to-capex ratios at 75.1x for semiconductors indicating either exceptional return expectations or warning signs. Technology sector concentration creates significant index risk, demanding more selective stock picking as AI fundamentals diverge across individual companies.

European Automotive Sector Faces Tariff and Structural Pressures | Links: [13], [14]

Volkswagen swung to a €1.3 billion Q3 operating loss from €2.8 billion profit, citing up to €5 billion annual US tariff costs and Porsche strategy reversal that has fundamentally altered the group's profitability outlook. The automotive industry's perfect storm extends beyond Europe: Nissan forecast $1.8 billion annual losses due to supply chain risks including Nexperia chip shortages, highlighting sector-wide challenges from trade tensions and structural shifts. The scale of losses reflects potential sector-wide recalibration of earnings expectations across both European and Asian manufacturers, with traditional business models under pressure from protectionist trade policies, supply chain vulnerabilities, and electric vehicle transition costs. European automotive faces significant headwinds that may require fundamental reassessment of valuations and business strategies, with implications extending throughout supplier networks and related industrial sectors across the continent.

| S&P 500 | 6822.34-38.16▼ -0.56% |

| FTSE 100 | 9760.10+4.00▲ +0.04% |

| CAC 40 | 8157.29-23.06▼ -0.28% |

| DAX 40 | 24118.90-68.90▼ -0.28% |

| Dow Jones | 47522.10+75.20▲ +0.16% |

| Euro Stoxx 50 | 5699.18-3.59▼ -0.06% |

| Hang Seng | 26282.70-263.20▼ -0.99% |

| Nasdaq 100 | 25734.80-219.00▼ -0.84% |

| Nasdaq Comp | 23581.10-212.00▼ -0.89% |

| Nikkei 225 | 51325.60+179.30▲ +0.35% |

| S&P/ASX 200 | 8885.50-40.70▼ -0.46% |

| Shanghai Comp | 3986.90-20.92▼ -0.52% |

| S&P 500 E-mini | 6899.75+44.25▲ +0.65% |

| Nasdaq 100 | 26191.00+308.25▲ +1.19% |

| FTSE 100 | 9759.00-29.00▼ -0.30% |

| Euro Stoxx 50 | 5697.00-9.00▼ -0.16% |

| WTI Crude | 60.14-0.43▼ -0.71% |

| Gold | 4007.90-8.00▼ -0.20% |

| Copper | 5.08-0.02▼ -0.38% |

| US 10Y Treasury | 112.69-0.02▼ -0.01% |

| UK 10Y Gilt | 118.18+0.01▲ +0.01% |

| German 10Y Bund | 129.38+0.02▲ +0.02% |

| Italian 10Y BTP | 121.34-0.11▼ -0.09% |

| US Dollar Index | 99.33-0.03▼ -0.03% |

| VIX Volatility | 18.60-0.51▼ -2.66% |

| SONIA 3M | 96.24-0.01▼ -0.01% |

• French Inflation Rate YoY Prel at 07:45 GMT - Previous: 1.2% - Key indicator for ECB policy direction as France is eurozone's second-largest economy.

• Italian Inflation Rate YoY Prel at 10:00 GMT - Previous: 1.6% - Critical for assessing eurozone inflation trends and ECB monetary policy stance.

• EU Inflation Rate YoY Flash at 10:00 GMT - Forecast: 2.1% vs Previous: 2.2% - Primary data point for ECB rate decisions with potential euro and bond market impact.

• US Core PCE Price Index MoM at 12:30 GMT - Forecast: 0.2% vs Previous: 0.2% - Fed's preferred inflation gauge will influence interest rate expectations and dollar strength.

• US Personal Income MoM at 12:30 GMT - Forecast: 0.4% vs Previous: 0.4% - Measures consumer spending power and economic resilience ahead of holiday season.

• US Personal Spending MoM at 12:30 GMT - Forecast: 0.4% vs Previous: 0.6% - Direct indicator of consumer demand driving two-thirds of US economic growth.

• Linde plc (LIN) at 10:00 GMT [Pre-Market] - Est: $4.18 vs Prev: $4.09 - Industrial gas giant's results will signal strength in manufacturing and healthcare demand across global markets.

• Chevron Corporation (CVX) at 10:15 GMT [Pre-Market] - Est: $1.71 vs Prev: $1.77 - Major oil producer's earnings will influence energy sector sentiment amid volatile crude prices and refining margins.

• Exxon Mobil Corporation (XOM) at 10:30 GMT [Pre-Market] - Est: $1.82 vs Prev: $1.64 - Energy sector bellwether's results will impact broader commodity markets and dividend sustainability expectations.

• PetroChina Co., Ltd. Class A (601857) at 12:00 GMT [Pre-Market] - Est: $0.03 vs Prev: $0.03 - China's largest oil producer will provide insight into Asian energy demand and state-owned enterprise performance.

• China Life Insurance Co. Ltd. Class A (601628) at 12:00 GMT [Pre-Market] - Est: TBD vs Prev: N/A - Leading Chinese insurer's results will reflect domestic consumer confidence and financial sector health.

• BYD Company Limited Class A (002594) at 12:00 GMT [Pre-Market] - Est: $0.20 vs Prev: $0.10 - Electric vehicle leader's performance will influence EV sector sentiment and Chinese manufacturing outlook.

• Intesa Sanpaolo S.p.A. (ISP) at 12:00 GMT [Pre-Market] - Est: $0.16 vs Prev: $0.16 - Italy's largest bank will signal European banking sector health amid interest rate environment changes.

• AbbVie Inc. (ABBV) at 13:30 GMT [During-Hours] - Est: $1.77 vs Prev: $2.97 - Pharmaceutical giant's results will impact healthcare sector amid patent cliff concerns and pipeline developments.

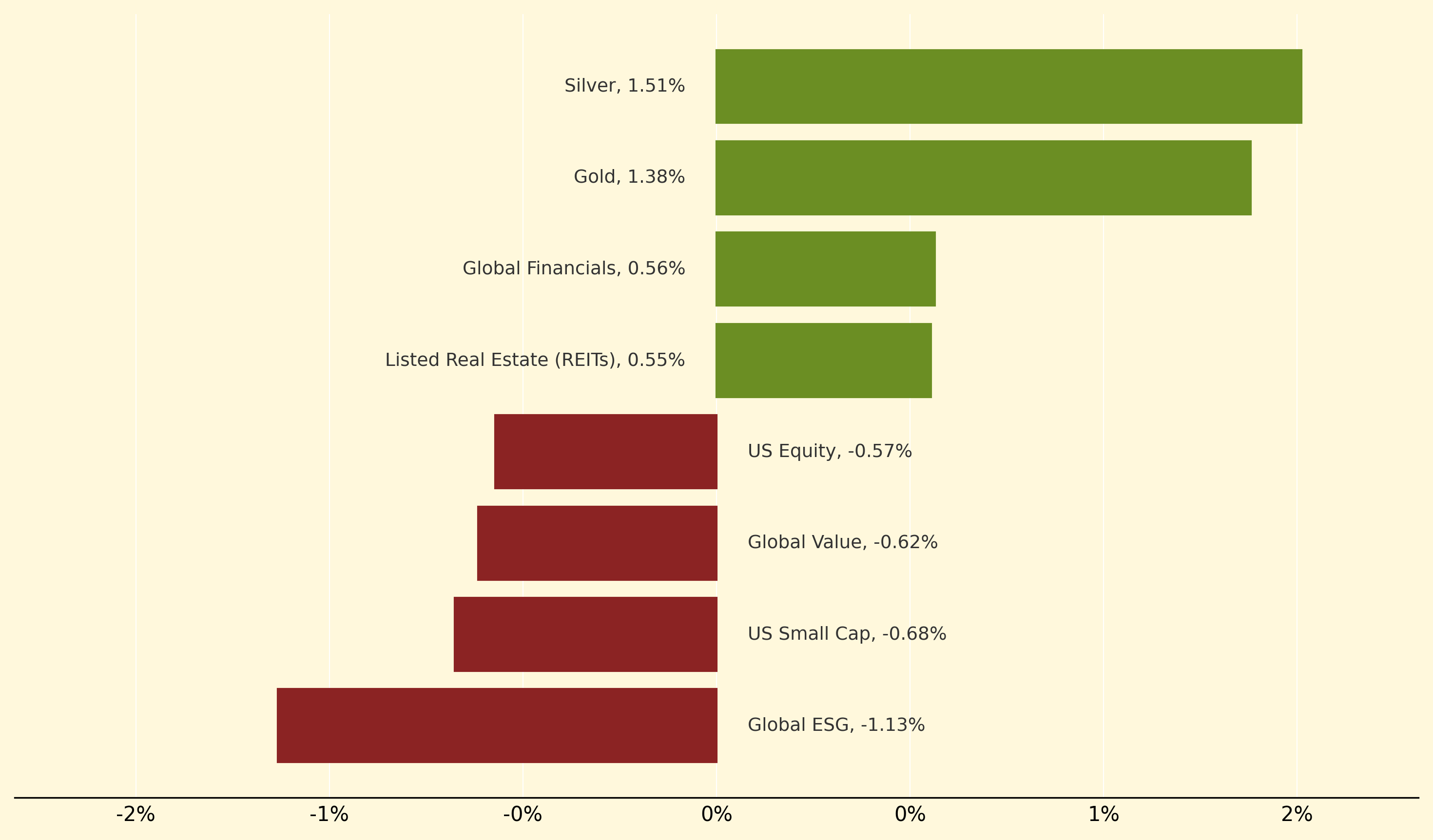

Precious metals dominated yesterday's winners, with Silver surging 1.51% and Gold advancing 1.38% as the Trump-Xi trade truce reduced geopolitical risk premiums and sparked safe-haven demand amid ongoing manufacturing weakness in China. Global Financials also gained 0.56%, benefiting from central bank hawkishness and reduced trade tensions, whilst Listed Real Estate climbed 0.55% as investors rotated toward yield-sensitive assets following the diplomatic breakthrough.

Conversely, Global ESG strategies suffered the steepest decline at -1.13%, reflecting broader investor scepticism toward sustainability mandates amid shifting political priorities following the US-China agreement. US equity exposure broadly underperformed, with US Small Cap falling -0.68% and both US Equity and US Large-Cap dropping -0.57% each, as Fed Chair Powell's warning that December rate cuts weren't "foregone conclusions" weighed on growth-sensitive domestic assets whilst investors favoured international diversification.

Correlation structures: The statistical relationships between asset price movements that traditionally provided portfolio diversification benefits, now breaking down as geopolitical risks cause previously uncorrelated emerging and developed market currencies to move together, challenging conventional risk models.

Thanks for reading Morning Fill. Have a great day!

Ollie and Harry