US-China Trade Framework Sparks Global Market Rally as Deal Details Emerge | Links: [1], [2], [3]

Treasury Secretary Bessent delivered the framework details markets had been awaiting: China will delay its rare earths export controls by one year and commit to substantial US soybean purchases, whilst the US shelves its threatened 100% tariffs. The comprehensive agreement, hammered out by high-level negotiators in Kuala Lumpur, also includes TikTok transfer arrangements and suspends shipping fee disputes—representing the most significant bilateral trade progress since tensions escalated. The framework now heads to a Trump-Xi summit in South Korea for final approval, though negotiator consensus suggests the heavy lifting is complete. Chinese stocks surged on the news whilst US agricultural futures rallied sharply on the purchase commitments.

Nikkei Breaks Historic 50,000 Barrier as Asian Markets Surge on Trade Optimism | Links: [4], [5], [6]

Japan's Nikkei 225 crossed 50,000 for the first time this morning, marking a psychological milestone that reflects the broad-based Asian equity strength driven by trade deal optimism. The historic breach comes ahead of high-level Trump-Takaichi diplomatic meetings and caps a region-wide rally that saw emerging Asian assets climb across the board on improved risk sentiment. China delivered its own validation of the recovery narrative with industrial profits surging 21.6% in September—the largest jump in nearly two years—reinforcing signals that the world's second-largest economy is gaining momentum. Market positioning accelerated with copper nearing record highs and commodity-linked currencies strengthening on improved China growth expectations.

US Inflation Cools to 3.0% as Wall Street Hits Fresh Records Despite Government Shutdown | Links: [7], [8], [9]

September CPI came in at 3.0% versus 3.1% expected, providing the Fed with additional ammunition for rate cuts despite the three-week government shutdown delaying the data release. All major US indices reached record highs with the S&P 500 and Nasdaq posting their largest weekly gains since August, driven by 87% of companies beating earnings estimates in what's shaping up as a stellar reporting season. Strong equity fund inflows of $9.65 billion signal renewed risk appetite ahead of this week's earnings deluge from the Magnificent Seven. However, Scope Ratings downgraded US sovereign credit amid the shutdown impasse, highlighting fiscal governance concerns even as economic fundamentals remain robust — a reminder that political dysfunction carries real costs even when markets appear to shrug it off.

European Sovereign Risk Concerns Mount as France Gets Moody's Warning | Links: [10], [11], [12]

Moody's revised France's outlook to negative whilst maintaining its Aa3 rating, citing political fragmentation risks hampering deficit reduction efforts after recent downgrades by Fitch, DBRS and S&P. The French government teeters over wealth tax proposals as Socialists pitch tax increases to prevent a budget crisis, creating a familiar European paradox where fiscal necessity collides with political reality. Despite these sovereign concerns, European stocks closed at record highs driven by US inflation data and global trade optimism, with the region's tech sector outperforming on AI investment momentum. French sovereign spreads have widened versus German bunds, but the broader market resilience indicates investors view the political instability as a French problem rather than a eurozone contagion risk—at least for now.

Copper Approaches Record High on Trade Deal Momentum and China Recovery | Links: [13], [14]

Copper is nearing record highs on the back of US-China trade framework progress and China's 21.6% industrial profit surge, with the broader base metals complex benefiting from improved bilateral relations and reduced supply chain disruption risks. Soybeans rallied sharply on the substantial Chinese purchase commitments embedded in the framework whilst agricultural futures extended gains across the board. Oil rose modestly on improved risk sentiment and economic recovery expectations, balancing new US sanctions on Russian producers Lukoil and Rosneft with growing demand optimism from trade resolution. The commodity complex reflects a market increasingly confident that China's recovery has substance and that trade normalisation will drive sustained industrial demand—positioning that could prove prescient if the framework delivers the infrastructure and manufacturing momentum that copper bulls anticipate.

| S&P 500 | 6791.69+19.62▲ +0.29% |

| FTSE 100 | 9645.60+67.00▲ +0.70% |

| CAC 40 | 8225.63-38.28▼ -0.46% |

| DAX 40 | 24239.90-36.10▼ -0.15% |

| Dow Jones | 47207.10+395.60▲ +0.85% |

| Euro Stoxx 50 | 5674.50-11.02▼ -0.19% |

| Hang Seng | 26160.20-16.90▼ -0.06% |

| Nasdaq 100 | 25358.20+50.40▲ +0.20% |

| Nasdaq Comp | 23204.90+61.70▲ +0.27% |

| Nikkei 225 | 49299.60+204.30▲ +0.42% |

| S&P/ASX 200 | 9019.00-13.80▼ -0.15% |

| Shanghai Comp | 3950.31+21.20▲ +0.54% |

| S&P 500 E-mini | 6881.25+54.25▲ +0.79% |

| Nasdaq 100 | 25776.00+266.75▲ +1.05% |

| FTSE 100 | 9685.50+13.00▲ +0.13% |

| Euro Stoxx 50 | 5702.00+22.00▲ +0.39% |

| WTI Crude | 61.72+0.22▲ +0.36% |

| Gold | 4088.00-49.80▼ -1.20% |

| Copper | 5.20+0.07▲ +1.43% |

| US 10Y Treasury | 113.19-0.25▼ -0.22% |

| UK 10Y Gilt | 118.18-0.07▼ -0.06% |

| German 10Y Bund | 129.32-0.14▼ -0.11% |

| Italian 10Y BTP | 121.16-0.42▼ -0.35% |

| US Dollar Index | 98.77+0.02▲ +0.02% |

| VIX Volatility | 17.90-0.74▼ -3.96% |

| SONIA 3M | 96.25-0.01▼ -0.01% |

• German Ifo Business Climate on Monday at 09:00 GMT - Forecast: 87.8 vs Previous: 87.7 - Key gauge of German business sentiment and eurozone economic momentum.

• US Durable Goods Orders MoM on Monday at 12:30 GMT - Forecast: 0.3% vs Previous: 2.9% - Critical indicator of US manufacturing strength and business investment demand.

• German GfK Consumer Confidence on Tuesday at 07:00 GMT - Forecast: -22.0 vs Previous: -22.3 - Measures German consumer sentiment affecting eurozone domestic demand.

• Japanese Consumer Confidence on Wednesday at 05:00 GMT - Forecast: 35.6 vs Previous: 35.3 - Important for yen movements and Bank of Japan policy expectations.

• Canadian BoC Interest Rate Decision on Wednesday at 13:45 GMT - Forecast: 2.25% vs Previous: 2.5% - Expected 25bp cut will impact CAD and North American rate differentials.

• US Fed Interest Rate Decision on Wednesday at 18:00 GMT - Forecast: 4.0% vs Previous: 4.25% - Anticipated 25bp cut with major implications for USD and global risk sentiment.

• Japanese BoJ Interest Rate Decision on Thursday at 03:00 GMT - Forecast: 0.5% vs Previous: 0.5% - Rate hold expected but guidance crucial for yen direction.

• German GDP Growth Rate QoQ Flash on Thursday at 09:00 GMT - Forecast: 0.0% vs Previous: -0.3% - Critical for eurozone recession fears and ECB policy path.

• EU GDP Growth Rate QoQ Flash on Thursday at 10:00 GMT - Forecast: 0.1% vs Previous: 0.1% - Eurozone growth momentum indicator ahead of ECB decision.

• US GDP Growth Rate QoQ Advance on Thursday at 12:30 GMT - Forecast: 3.0% vs Previous: 3.8% - Key measure of US economic resilience supporting dollar strength.

• EU ECB Interest Rate Decision on Thursday at 13:15 GMT - Forecast: 2.15% vs Previous: 2.15% - Rate hold expected but dovish guidance likely given weak growth.

• Chinese NBS Manufacturing PMI on Friday at 01:30 GMT - Forecast: 49.6 vs Previous: 49.8 - Critical for global growth expectations and commodity demand.

• EU Inflation Rate YoY Flash on Friday at 10:00 GMT - Forecast: 2.1% vs Previous: 2.2% - Key for ECB policy trajectory and euro direction.

• US Core PCE Price Index MoM on Friday at 12:30 GMT - Forecast: 0.2% vs Previous: 0.2% - Fed's preferred inflation gauge crucial for future rate cut expectations.

• HSBC Holdings (HSBA) on Tuesday at 04:00 GMT Pre-Market - $229.9B - Europe's largest bank by assets reports Q3 results, key indicator for UK banking sector and Asian market exposure amid rate environment changes.

• Iberdrola (IBE) on Tuesday at 07:00 GMT Pre-Market - $131.5B - Spanish utility giant's earnings will signal renewable energy transition progress and European power market conditions for the sector.

• UnitedHealth Group (UNH) on Tuesday at 09:55 GMT Pre-Market - $328.3B - Largest US health insurer's results provide crucial insight into healthcare cost trends and insurance market dynamics.

• Visa (V) on Tuesday at 20:00 GMT During-Hours - $669.3B - Global payments leader's consumer spending data offers key economic indicator for global transaction volumes and digital payment adoption.

• Microsoft (MSFT) on Wednesday at 20:00 GMT During-Hours - $3.9T - Tech giant's cloud and AI revenue growth critical for Nasdaq direction and enterprise technology spending trends.

• Alphabet (GOOG) on Wednesday at 20:00 GMT During-Hours - $3.1T - Google parent's digital advertising and cloud performance will signal broader tech sector health and AI investment returns.

• Meta Platforms (META) on Wednesday at 20:00 GMT During-Hours - $1.9T - Social media leader's user engagement and metaverse spending updates crucial for tech sector sentiment and advertising market strength.

• Eli Lilly (LLY) on Thursday at 10:45 GMT Pre-Market - $781.3B - Pharmaceutical giant's diabetes and obesity drug revenues key driver for healthcare sector and weight-loss treatment market expansion.

• Amazon (AMZN) on Thursday at 20:01 GMT During-Hours - $2.4T - E-commerce and cloud leader's AWS growth and retail margins critical for consumer discretionary sector and cloud computing outlook.

• Apple (AAPL) on Thursday at 20:30 GMT During-Hours - $3.9T - iPhone maker's quarterly results anchor tech sector performance with services revenue and China market exposure in focus.

• Exxon Mobil (XOM) on Friday at 10:30 GMT Pre-Market - $491.9B - Energy giant's production and refining margins provide key insight into oil sector profitability and energy market conditions.

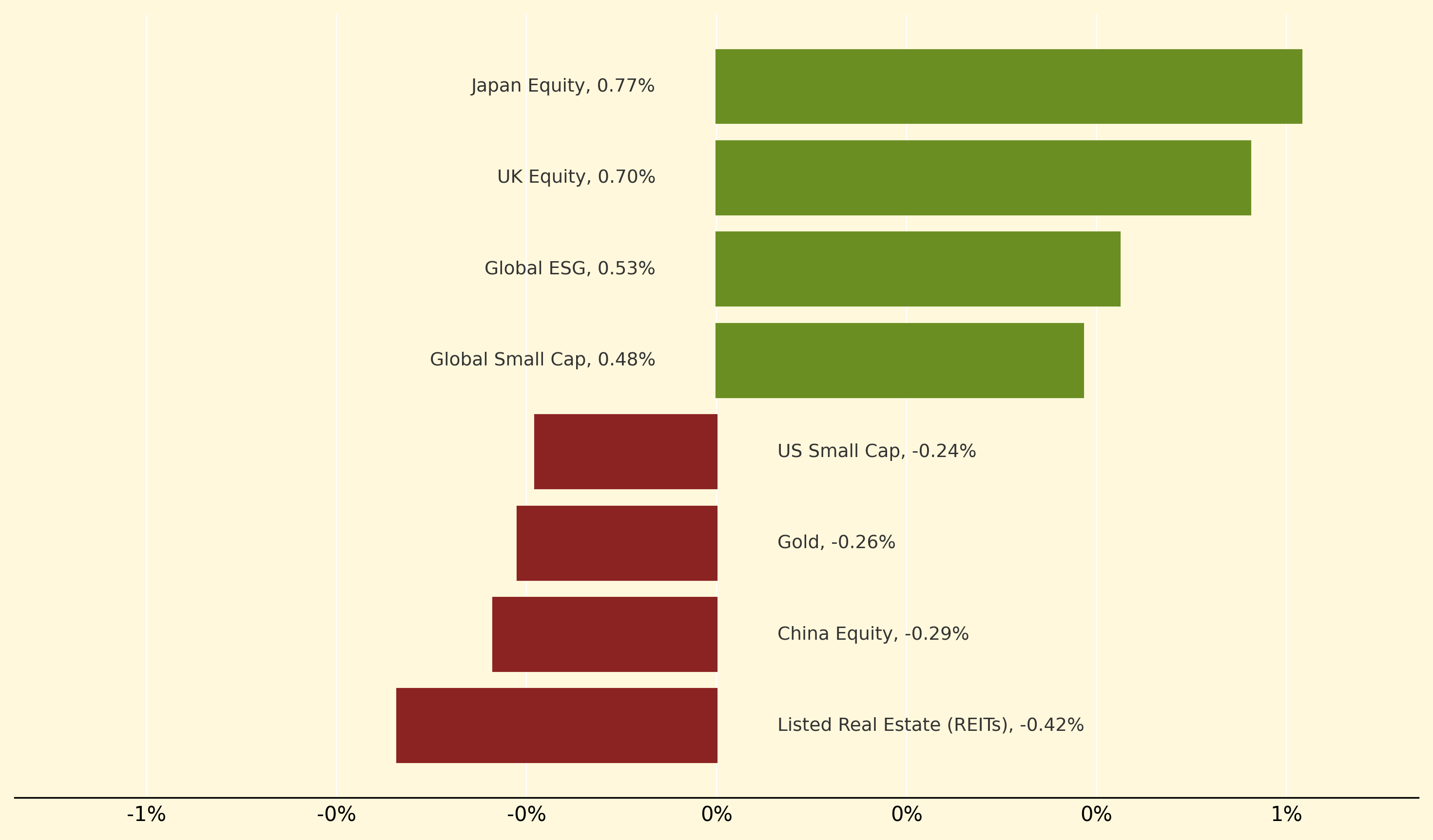

Japan Equity led the winners with a 0.77% gain as the Nikkei crossed the historic 50,000 barrier for the first time, riding the wave of US-China trade deal optimism that sparked broad Asian market strength. UK Equity also performed well, advancing 0.70% amid record European stock closes, whilst Global ESG gained 0.53% as investors embraced risk-on sentiment following the trade framework breakthrough.

Conversely, Listed Real Estate (REITs) underperformed significantly, dropping 0.42% as rising rate cut expectations and improved risk appetite shifted capital away from yield-focused sectors. China Equity also lagged, falling 0.29% despite the positive trade developments, whilst precious metals Gold and Silver declined 0.26% and 0.20% respectively as the stronger dollar and reduced safe-haven demand weighed on commodity prices.

Sovereign spreads: The additional yield investors demand to hold a country's government bonds over a benchmark like German bunds, reflecting perceived credit risk and political stability. Widening spreads indicate growing concerns about a nation's fiscal health or governance.

Thanks for reading Morning Fill. Have a great day!

Ollie and Harry