Major Institutions Sound AI Bubble Alarm | Links: [1], [2], [3], [4]

A convergence of institutional warnings has unsettled markets as the IMF, Bank of England, and JPMorgan CEO Jamie Dimon simultaneously flagged an AI bubble threatening global financial stability. Bank of England officials specifically cautioned that bubble conditions could emerge rapidly if artificial intelligence equity valuations face downgrades, whilst Dimon highlighted broader correction risks across US equity markets. The IMF flagged systemic dangers from AI investment euphoria that mirrors the late-1990s dotcom boom. This chorus emerges as US options traders display euphoria reminiscent of previous bubble periods, with fear-of-missing-out driving unprecedented risk-taking across technology sectors that have powered significant portions of global equity gains this year.

Gold Shatters $4,000 Barrier in Historic Safe-Haven Surge | Links: [5], [6], [7], [8]

Gold has obliterated the $4,000 per ounce threshold for the first time, cementing its position as 2025's standout asset with gains of 53% that outperform both bitcoin and the S&P 500. This week represents the eighth consecutive weekly rise, with the precious metal rising alongside equities rather than inversely—breaking traditional correlation models that have underpinned portfolio diversification strategies for decades. Silver has surged to multi-decade highs above $51, reaching levels not witnessed since the 1980s. The rally reflects mounting concerns about dollar debasement, central bank reserve diversification, and geopolitical uncertainty. Deutsche Bank predicts central banks will hold bitcoin alongside gold as key reserves by 2030, signalling broader transformation in monetary architecture that forces investors to completely rethink diversification models and risk management strategies.

China Escalates Tech War Through Supply Chain Weaponisation | Links: [9], [10], [11], [12]

Beijing has launched a coordinated escalation of tech trade tensions, simultaneously tightening export controls on rare earth materials, ramping up customs crackdowns on Nvidia AI chip imports, and blacklisting major chip research firm TechInsights over its Huawei analysis. Fresh restrictions on battery supply chain materials target the global energy transition, whilst rare earth controls affect virtually all technology manufacturing from smartphones to renewable systems. China dominates roughly 80% of global rare earth processing and controls critical battery material supply chains, giving Beijing substantial leverage over Western technology and clean energy sectors. The timing indicates China is positioning for strength in upcoming Trump-Xi trade negotiations whilst demonstrating its willingness to weaponise supply chain dependencies that have become fundamental to global economic architecture.

Record $152 Billion Outflow Drives Historic US-to-International Equity Rotation | Links: [13], [14]

Massive $152 billion outflows from US growth funds are fuelling the largest global equity rotation in years, with investors flooding into 'ex-US' and international value strategies amid mounting concerns about American equity valuations. EAFE value equities have reached record performance levels whilst remaining attractively priced relative to US counterparts, benefiting from dovish monetary policy overseas and a weakening dollar environment. This unprecedented capital reallocation reflects institutional recognition that US growth stocks, particularly in technology, have become dangerously overextended after years of concentration. The rotation encompasses both geographic diversification away from US market dominance and style rotation from expensive growth toward undervalued international opportunities, with European markets emerging as primary beneficiaries as investors seek exposure to industrial, financial, and commodity sectors that remain cheap compared to US equivalents.

Gaza Ceasefire Breakthrough Compresses Geopolitical Risk Premiums | Links: [15], [16], [17], [18]

Israel and Hamas have agreed to the first phase of Donald Trump's Gaza peace plan, marking a potentially transformative moment for Middle East stability after over a year of devastating conflict. The ceasefire agreement includes prisoner and hostage exchanges, with approximately 200 US troops being deployed to support implementation and monitoring. Oil prices immediately fell 1.6% as geopolitical risk premiums compressed across energy markets, whilst defence sector shares—which have surged 120% during the conflict—face potential headwinds as tensions ease. This breakthrough represents the first significant diplomatic progress in the region in years, potentially reducing elevated risk premiums that have supported energy prices and weighed on regional investment flows, though fragility remains given the complex underlying issues that sparked the crisis.

| Dow Jones Industrial Average | --▼ -0.57% |

| S&P 500 | --▼ -0.38% |

| Hang Seng Index | --▼ -0.41% |

| FTSE 100 | --▼ -0.41% |

| CAC 40 | --▼ -0.41% |

| DAX 40 | --▼ -0.26% |

| Euro Stoxx 50 | --▼ -0.45% |

| Nasdaq Composite | --▼ -0.09% |

| Nasdaq-100 | --▼ -0.11% |

| Nikkei 225 | --▲ +1.13% |

| S&P/ASX 200 | --▲ +0.25% |

| Shanghai Composite | --▲ +0.91% |

| S&P 500 E-mini | 6785.25+6.00▲ +0.09% |

| Nasdaq-100 | 25319.00+29.75▲ +0.12% |

| FTSE 100 Index | 9535.50-23.00▼ -0.24% |

| EURO STOXX 50 | 5637.00-6.00▼ -0.11% |

| WTI Crude Oil | 61.36-0.15▼ -0.24% |

| Gold (COMEX) | 3990.80+18.20▲ +0.46% |

| Copper (COMEX) | 5.10-0.02▼ -0.48% |

| US 10-Year Treasury | 112.61+0.12▲ +0.11% |

| UK Long Gilt (10Y) | 117.93+0.03▲ +0.03% |

| German Bund (10Y) | 128.76+0.10▲ +0.08% |

| Italian BTP (10Y) | 120.08-0.25▼ -0.21% |

| US Dollar Index | 99.06-0.10▼ -0.10% |

| VIX Volatility | 17.70+0.00▲ +0.00% |

| SONIA 3M Interest Rate | 96.11-0.01▼ -0.01% |

• Italian Industrial Production MoM at 09:00 BST - Forecast: -0.3% vs Previous: 0.4% - Signals potential weakness in the eurozone's third-largest economy, impacting EUR and European manufacturing sector sentiment.

• Canadian Unemployment Rate at 13:30 BST - Forecast: 7.1% vs Previous: 7.1% - Key indicator for Bank of Canada policy direction with CAD and Canadian bond yields sensitive to labour market changes.

• Canadian Employment Change at 13:30 BST - Forecast: 2.8K vs Previous: -65.5K - Recovery from sharp job losses could support CAD strength and influence BoC monetary policy stance.

• US Michigan Consumer Sentiment Preliminary at 15:00 BST - Forecast: 55.0 vs Previous: 55.1 - Critical gauge of US consumer confidence affecting Fed policy expectations and broader market risk appetite.

• US Fed Goolsbee Speech at 14:45 BST - Fed officials' commentary on monetary policy outlook could drive USD volatility and Treasury yield movements.

• Tryg A/S (TRYG) at 06:30 BST [Pre-Market] - Est: $0.37 vs Prev: $0.39 - Nordic insurance leader's results will signal regional financial sector health and guide European insurance valuations.

• Zegona Communications Plc (ZEG) at 13:00 BST [Pre-Market] - Est: TBD vs Prev: N/A - UK telecom investment vehicle's performance impacts European media and communications sector sentiment.

• LARGAN Precision Co., Ltd. (3008) at 13:00 BST [Pre-Market] - Est: $1.75 vs Prev: $0.26 - Major Apple supplier's results will influence global technology hardware supply chain outlook and smartphone demand expectations.

• Ryohin Keikaku Co., Ltd. (7453) at 13:00 BST [Pre-Market] - Est: $0.07 vs Prev: $0.24 - Muji parent company's performance reflects Japanese consumer spending trends and global retail recovery patterns.

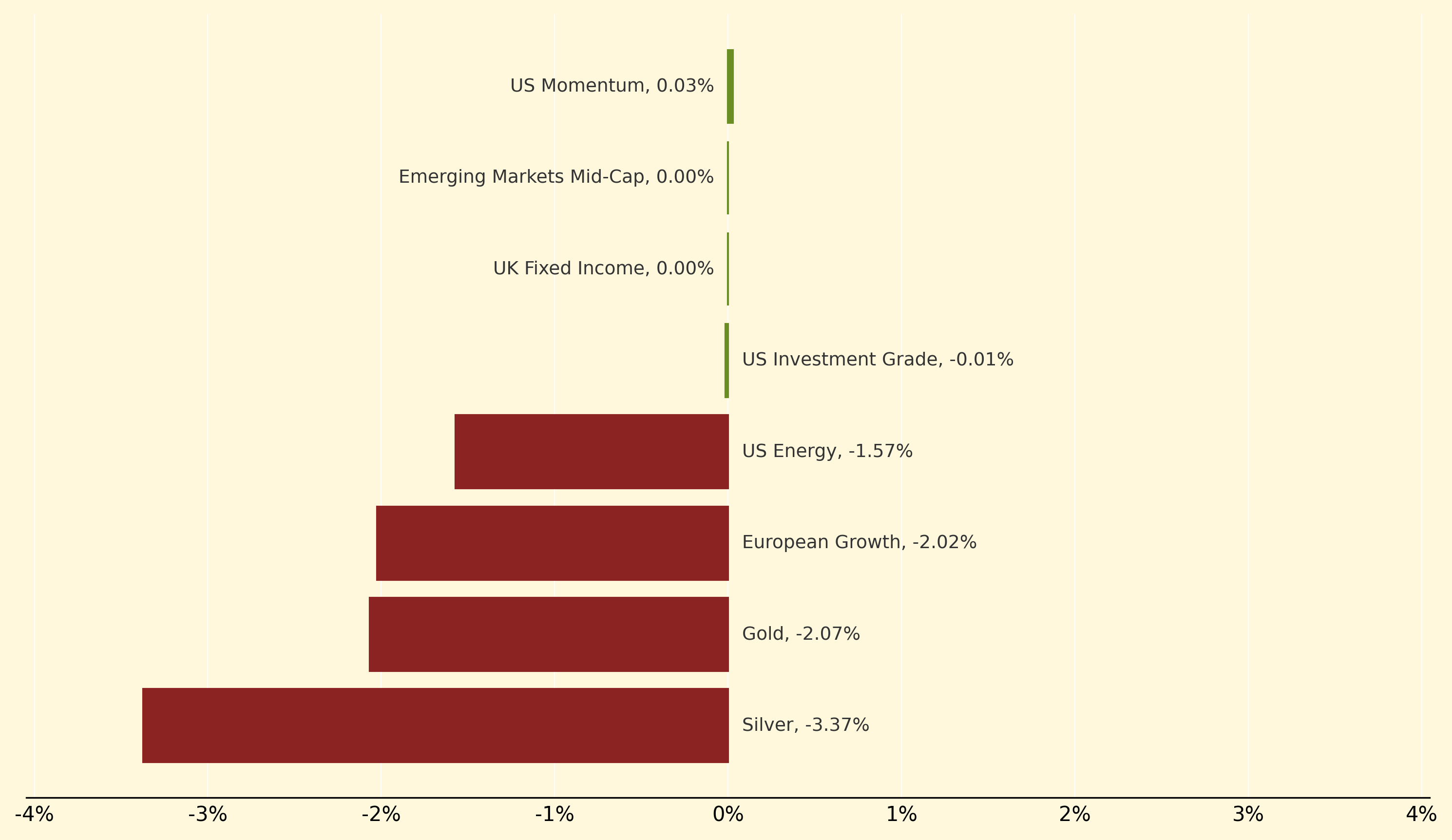

US Momentum posted the only meaningful gain at 0.03%, standing out in an otherwise flat session where most strategies barely moved. Emerging Markets Mid-Cap and UK Fixed Income remained unchanged, whilst even typically stable US Investment Grade and TIPS posted minor declines of -0.01% and -0.11% respectively, reflecting cautious sentiment amid mounting AI bubble warnings from major institutions.

Precious metals suffered severe losses as Silver plummeted -3.37% and Gold dropped -2.07% despite recent record highs above $4,000, indicating profit-taking after the eighth consecutive weekly rise. European Growth fell -2.02% amid broader international equity weakness, whilst US Energy declined -1.57% as oil prices dropped following the Gaza ceasefire breakthrough that compressed geopolitical risk premiums. China Equity's -1.53% decline reflected ongoing tech trade tensions as Beijing escalated export controls on rare earth materials and tightened customs crackdowns on Nvidia chips.

Supply chain weaponisation: The strategic use of critical material dependencies and trade controls as geopolitical leverage, where dominant suppliers restrict exports of essential components to gain negotiating power or inflict economic damage on rivals.

Thanks for reading Morning Fill. Have a great day!

Ollie and Harry