Central Banks Sound Alarm on AI Bubble as Markets Hit Records | Links: [1], [2]

The Bank of England and IMF delivered coordinated warnings about potential "sharp market corrections" should sentiment turn on AI valuations, marking the first time major central banks have explicitly compared current tech stock levels to dotcom bubble peaks. The BoE's Financial Policy Committee warned that equity markets appear "particularly exposed" should expectations shift on artificial intelligence or Federal Reserve independence, whilst the IMF echoed concerns about an "abrupt" correction. This represents a critical escalation beyond previous investor warnings, with central banks now publicly intervening on asset price risks during record market highs. The timing proves particularly pointed — these warnings arrive as AI-driven rallies push major indices to fresh records, creating an uncomfortable tension between celebration and caution that defines today's market psychology.

Israel-Hamas Ceasefire Breakthrough Reduces Middle East Risk Premium | Links: [3]

Israel and Hamas agreed to the first phase of a Gaza peace plan allowing hostage and prisoner releases, marking the most significant diplomatic breakthrough after more than a year of devastating conflict. The agreement immediately reduced geopolitical risk premiums across energy markets, with oil prices retreating from elevated levels and regional equity markets rallying on reduced uncertainty. This development provides temporary relief from Middle East tensions that have supported elevated risk premiums across global portfolios, though implementation risks and potential ceasefire fragility remain significant concerns. The market reaction proved swift—energy sector positioning that had benefited from geopolitical premiums now faces near-term headwinds, whilst broader risk assets welcomed the reduced tail risk from one of the year's most persistent geopolitical flashpoints.

Fed Minutes Reveal Divided Views on Inflation Despite Rate Cut Path | Links: [4], [5]

Federal Reserve minutes from September showed officials remain cautiously divided on inflation prospects despite cutting rates, with many expecting just two additional cuts by the end of 2025, fewer than markets had priced. The minutes revealed ongoing debates about balance sheet runoff and bank reserve levels, with policymakers expressing persistent concern about inflation pressures that could derail the easing cycle. This tension between accommodative policy and inflation vigilance emerges as Fed custody holdings fell to 13-year lows, potentially signalling reduced foreign central bank demand for Treasuries. The cautious stance contrasts sharply with market expectations for more aggressive easing, setting up potential dollar strength should Fed officials prove more hawkish than anticipated.

China Escalates Tech War with Expanded Rare Earth Export Controls | Links: [6], [7]

China announced sweeping new rare earth export controls targeting defence and semiconductor users, escalating trade tensions in critical materials where China controls 90% of global processing capacity. The measures restrict exports of processed rare earths essential for everything from electric vehicles to military systems, directly challenging US and Western supply chain security at a moment when technology export controls dominate geopolitical discourse. This coincides with US approval of some Nvidia chip sales to the UAE under bilateral AI agreements, highlighting the complex web of technology restrictions that now define competition. The timing underscores China's willingness to weaponise its rare earth dominance as semiconductor restrictions intensify, creating new vulnerabilities for Western technology and defence companies that had grown comfortable with Chinese supply chain dependence.

HSBC's $37 Billion Hang Seng Bet Signals Asian Banking Consolidation | Links: [8], [9]

HSBC proposed the largest Hong Kong banking acquisition in over a decade with a $37 billion privatisation bid for Hang Seng Bank, sending shares up 30% and signalling CEO Elhedery's strategic concentration on Asian markets. The deal represents confidence in Hong Kong's financial hub status despite ongoing China-related uncertainties and property market challenges that have weighed on the territory's banking sector. This follows broader themes of financial sector restructuring, with UBS simultaneously examining $500 million exposure to collapsed First Brands. The transaction suggests major international banks remain committed to Asian growth despite regulatory headwinds, even as alternative credit markets reveal new pockets of vulnerability that demand closer scrutiny.

| Dow Jones Industrial Average | --▼ -0.10% |

| S&P 500 | --▲ +0.44% |

| Hang Seng Index | --▼ -0.26% |

| FTSE 100 | --▲ +0.69% |

| CAC 40 | --▲ +0.96% |

| DAX 40 | --▲ +0.88% |

| Euro Stoxx 50 | --▲ +0.99% |

| Nasdaq Composite | --▲ +0.84% |

| Nasdaq-100 | --▲ +1.00% |

| Nikkei 225 | --▼ -0.40% |

| S&P/ASX 200 | --▼ -0.10% |

| S&P 500 E-mini | 6802.00+0.75▲ +0.01% |

| Nasdaq-100 | 25345.50+14.50▲ +0.06% |

| FTSE 100 Index | 9552.50-50.00▼ -0.52% |

| EURO STOXX 50 | 5658.00-11.00▼ -0.19% |

| WTI Crude Oil | 62.25-0.30▼ -0.48% |

| Gold (COMEX) | 4055.50-15.00▼ -0.37% |

| Copper (COMEX) | 5.15+0.06▲ +1.11% |

| US 10-Year Treasury | 112.62+0.02▲ +0.01% |

| UK Long Gilt (10Y) | 118.02-0.02▼ -0.02% |

| German Bund (10Y) | 128.86-0.05▼ -0.04% |

| Italian BTP (10Y) | 120.33+0.55▲ +0.46% |

| US Dollar Index | 98.44-0.12▼ -0.12% |

| VIX Volatility | 17.55-0.10▼ -0.56% |

| SONIA 3M Interest Rate | 96.12+0.00▲ +0.00% |

• German Balance of Trade at 07:00 BST - Forecast: €15.1B vs Previous: €14.7B - Strong export performance could support the euro and indicate resilience in Germany's manufacturing sector amid global economic headwinds.

• ECB Monetary Policy Meeting Accounts at 12:30 BST - Previous meeting insights - Will reveal policymakers' discussions on future rate decisions and inflation outlook, potentially moving euro and European bond yields.

• US Initial Jobless Claims at 13:30 BST - Forecast: 223K vs Previous: 218K - Labour market strength remains crucial for Fed policy direction and could influence dollar sentiment ahead of next rate decision.

• US Fed Chair Powell Speech at 13:30 BST - Policy guidance expected - Powell's comments on inflation progress and rate outlook will be closely watched for signals on December Fed meeting stance.

• US Fed Bowman Speech at 13:35 BST - Hawkish member's view - Known for her cautious approach to rate cuts, her remarks could provide insights into internal Fed debate on policy normalisation.

• PepsiCo, Inc. (PEP) at 11:00 BST [Pre-Market] - Est: $2.26 vs Prev: $2.12 - Mega-cap consumer staples earnings could signal broader consumer spending trends and inflationary pressures across food and beverage sectors.

• Delta Air Lines, Inc. (DAL) at 11:30 BST [Pre-Market] - Est: $1.53 vs Prev: $2.10 - Major airline results will indicate travel demand recovery and fuel cost impacts on transportation sector profitability.

• Progressive Corporation (The) (PGR) at 13:00 BST [Pre-Market] - Est: $4.81 vs Prev: $4.88 - Leading insurer's results may reflect auto insurance pricing trends and claims patterns affecting the broader financial services sector.

• Tata Consultancy Services Limited (TCS) at 13:00 BST [Pre-Market] - Est: $0.39 vs Prev: $0.41 - India's largest IT services firm will signal demand for technology consulting and digital transformation spending globally.

• FAST RETAILING CO., LTD. (9983) at 13:00 BST [Pre-Market] - Est: $1.36 vs Prev: $2.39 - Uniqlo parent company results will indicate Asian retail consumption trends and global apparel market conditions.

• Levi Strauss & Co (LEVI) at 21:10 BST [During-Hours] - Est: $0.31 vs Prev: $0.22 - Iconic denim brand's performance will reflect consumer discretionary spending and retail inventory management in challenging economic conditions.

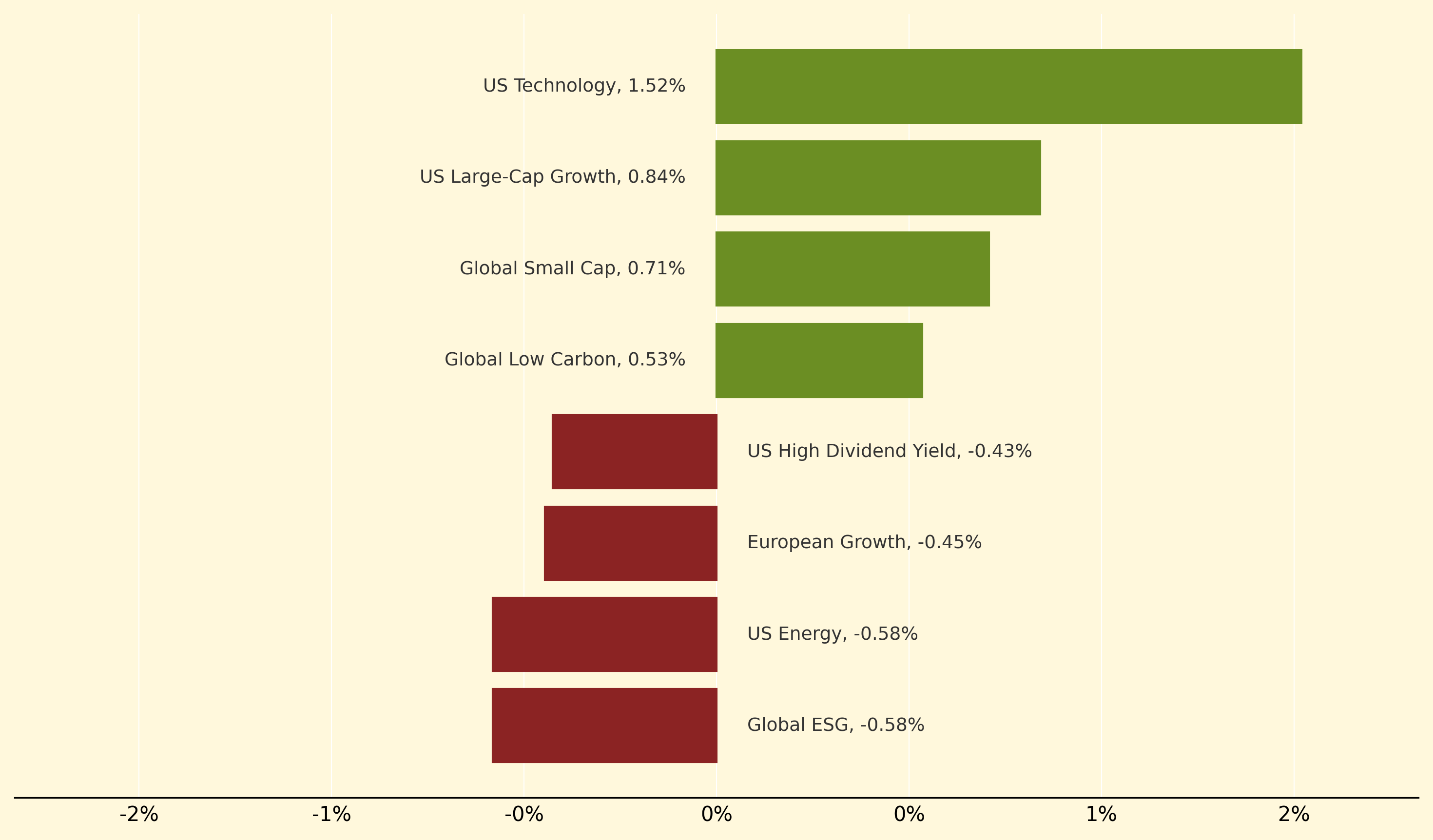

US Technology surged 1.52% as central bank warnings about AI bubble risks paradoxically fuelled further tech momentum, with investors interpreting regulatory concern as validation of AI's transformative potential. US Large-Cap Growth followed with a solid 0.84% gain, whilst Global Small Cap advanced 0.71% amid renewed risk appetite despite Fed officials signalling just two more rate cuts through 2025.

Conversely, US Energy dropped 0.58% as the Israel-Hamas ceasefire breakthrough immediately reduced Middle East risk premiums that had supported oil prices and energy positioning. Global ESG also fell 0.58%, whilst European Growth declined 0.45% as France's political chaos and broader European uncertainties weighed on regional strategies despite the STOXX hitting record highs.

Custody holdings: Securities held by the Federal Reserve on behalf of foreign central banks and international institutions, serving as a key indicator of international demand for US government debt and dollar-denominated assets in the global financial system.

Thanks for reading Morning Fill. Have a great day!

Ollie and Harry