US Government Enters First Shutdown Since 2019 | Links: [1], [2], [3], [4]

Washington's fiscal dysfunction has materialised as the United States enters its first government shutdown since 2019, immediately unsettling global markets and creating a data blackout that complicates Federal Reserve decision-making. US equity futures declined whilst the dollar weakened, with traders pricing in a 96% probability of Fed rate cuts amid the political chaos. The shutdown threatens to delay critical economic indicators including non-farm payrolls and inflation reports just as central banks globally navigate policy decisions. Bond traders are already positioning for a Treasury rally, whilst systematic strategies commanding $1 - 1.5 trillion in assets could amplify market moves if volatility spikes from historically low levels.

Japan Central Bank Cuts Bond Purchases, Signals Rate Hike Path | Links: [5], [6]

The Bank of Japan reduced monthly bond purchases by ¥400 billion as expected whilst business sentiment surveys revealed improvement, strengthening the case for a rate hike as early as this month. Markets are pricing a 60% probability of a move to 0.75%, marking a significant shift in global monetary policy dynamics as the BOJ moves toward normalisation whilst other central banks ease. Japanese government bonds are experiencing their worst rout since the regime change began, with yields rising across the curve as investors anticipate the end of ultra-loose monetary policy. The improved business sentiment coincides with manufacturing data showing resilience despite US tariff pressures, providing the BOJ with confidence to continue policy normalisation and creating substantial implications for global carry trades.

European Inflation Accelerates, Reducing ECB Rate Cut Pressure | Links: [7], [8]

Eurozone inflation data reveals an uptick across major economies as energy price declines moderate, with German inflation rising to 2.4% in September—the highest level since February and above ECB expectations. The acceleration stems from slower falls in energy prices rather than broad-based price pressures, but nonetheless signals persistent inflationary dynamics in Europe's largest economy. ECB President Lagarde characterised inflation risks as "quite contained" in each direction, maintaining a measured tone despite the uptick. However, the combination of German inflation exceeding forecasts and similar trends across other eurozone members reduces the case for aggressive ECB easing, creating potential policy divergence with the Federal Reserve and affecting euro positioning as investors recalibrate expectations for the ECB's policy trajectory.

Asian Manufacturing Diverges Under Trump Tariff Pressure | Links: [9], [10], [11]

Asian manufacturing data reveals stark regional divergence as Trump's expanding tariff regime creates clear winners and losers across the region. South Korea and Vietnam weather the trade pressures better than expected, whilst Taiwan and Japan show signs of strain. China continues its manufacturing contraction for the sixth consecutive month, reflecting both domestic demand weakness and external trade headwinds. Korean exports actually dipped as US tariffs outweighed the benefit of extra working days, demonstrating the tangible impact of trade policy on major Asian exporters. Meanwhile, Taiwan rejected a 50-50 semiconductor production sharing proposal with the US, highlighting ongoing tensions in the critical chip supply chain. The data suggests early evidence of supply chain reallocation as companies adapt to the new trade environment.

UK Business Confidence Plumbs Record Lows Ahead of Budget | Links: [12], [13], [14]

UK business confidence has plummeted to record lows since the Brexit referendum, with the Institute of Directors reporting a dire -74 reading as companies brace for Labour's first budget. The collapse in sentiment reflects widespread fears about potential tax increases, employment cost rises, and regulatory uncertainty under the new government. Despite this pessimism, UK house prices rose 0.5% above forecasts according to Nationwide, whilst the FTSE 100 sealed its best quarterly rise since 2022, reaching record highs. The contrast between plummeting business confidence and resilient asset prices creates a complex picture for UK positioning, particularly as London's decline to 23rd in global IPO rankings underscores broader competitiveness concerns. This environment of policy uncertainty and mixed economic signals sets the stage for challenging Q4 allocation decisions in UK assets.

| Dow Jones Industrial Average | --▲ +0.25% |

| S&P 500 | --▲ +0.48% |

| Hang Seng Index | --▲ +0.68% |

| FTSE 100 | --▲ +0.54% |

| CAC 40 | --▲ +0.39% |

| DAX 40 | --▲ +0.65% |

| Euro Stoxx 50 | --▲ +0.49% |

| Nasdaq Composite | --▲ +0.35% |

| Nasdaq-100 | --▲ +0.34% |

| Nikkei 225 | --▼ -0.27% |

| S&P/ASX 200 | --▼ -0.16% |

| Shanghai Composite | --▲ +0.34% |

| S&P 500 E-mini | 6686.75-52.00▼ -0.77% |

| Nasdaq-100 | 24670.80-231.00▼ -0.93% |

| FTSE 100 Index | 9426.00+18.50▲ +0.20% |

| EURO STOXX 50 | 5523.00-18.00▼ -0.32% |

| WTI Crude Oil | 62.78+0.41▲ +0.66% |

| Gold (COMEX) | 3900.80+27.60▲ +0.71% |

| Copper (COMEX) | 4.86+0.00▲ +0.03% |

| US 10-Year Treasury | 112.45-0.05▼ -0.04% |

| UK Long Gilt (10Y) | 117.66-0.15▼ -0.13% |

| German Bund (10Y) | 128.29-0.28▼ -0.22% |

| Italian BTP (10Y) | 119.51-0.33▼ -0.28% |

| US Dollar Index | 97.28-0.21▼ -0.22% |

| VIX Volatility | 18.20+0.61▲ +3.48% |

| SONIA 3M Interest Rate | 96.11-0.01▼ -0.01% |

• EU Inflation Rate YoY Flash at 10:00 BST - Forecast: 2.3% vs Previous: 2.0% - Key data for ECB policy expectations as inflation approaches the 2% target, impacting euro and European bond yields.

• US ISM Manufacturing PMI at 15:00 BST - Forecast: 49.2 vs Previous: 48.7 - Critical gauge of US manufacturing health with readings below 50 signalling contraction, affecting dollar strength and industrial sector sentiment.

• IT HCOB Manufacturing PMI at 08:45 BST - Forecast: 50.0 vs Previous: 50.4 - Italian factory activity indicator providing insights into eurozone's third-largest economy and broader regional manufacturing trends.

• EU Core Inflation Rate YoY Flash at 10:00 BST - Forecast: 2.3% vs Previous: 2.3% - Underlying price pressure measure excluding volatile items, crucial for ECB monetary policy assessment and euro direction.

• US ADP Employment Change at 13:15 BST - Forecast: 30.0K vs Previous: 54.0K - Private payrolls preview ahead of Friday's official jobs report, influencing Fed policy expectations and treasury yields.

• CA BoC Summary of Deliberations at 18:30 BST - Bank of Canada's detailed policy discussion notes providing insights into future rate decisions and supporting loonie sentiment.

• Zegona Communications Plc (ZEG) at 13:00 BST [Pre-Market] - Est: N/A vs Prev: N/A - European telecom consolidation play could signal broader sector M&A activity and infrastructure investment trends.

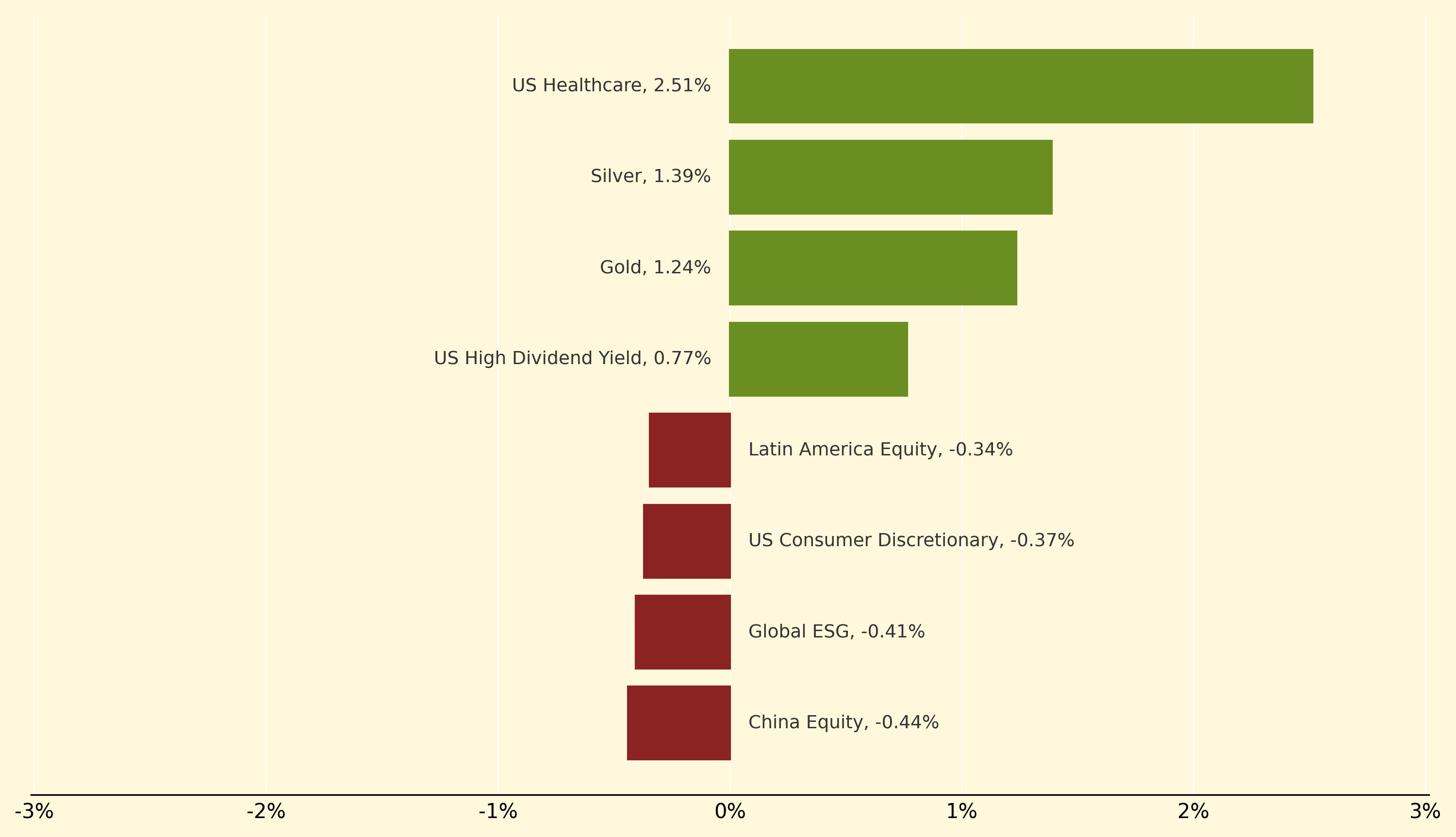

US Healthcare surged 2.51% as defensive positioning intensified amid the government shutdown, with investors seeking refuge in sectors less exposed to federal spending disruptions. Precious metals also rallied strongly, with Silver gaining 1.39% and Gold advancing 1.24% to fresh record highs as safe-haven demand accelerated on political uncertainty and Fed rate cut expectations reaching 96%.

China Equity declined 0.44% as manufacturing data revealed the sixth consecutive month of contraction, compounded by ongoing US tariff pressures and the BHP iron ore cargo ban deepening trade tensions. Global ESG strategies also underperformed, falling 0.41%, whilst US Consumer Discretionary dropped 0.37% as shutdown concerns weighed on domestic spending sentiment and retail positioning ahead of the critical Q4 period.

Systematic strategies: Quantitative investment approaches using algorithmic models that automatically execute trades based on predetermined rules, managing $1-1.5 trillion globally and potentially amplifying market volatility during periods of low liquidity or sudden regime changes.

Thanks for reading Morning Fill. Have a great day!

Ollie and Harry