US Government Shutdown Risk Reaches Critical 70% as Data Blackout Looms | Links: [1], [2], [3]

Prediction markets price a 70% probability of US government shutdown beginning Monday, potentially setting up the most disruptive data blackout in recent memory. The blackout, the first since Trump’s initial term in 2018, will occur if a funding plan isn’t agreed between both parties by 00.01am on Wednesday 1 October. The Labor Department would suspend critical economic releases including September's jobs report, creating an information vacuum precisely when the Federal Reserve requires clarity on labour market conditions to guide policy decisions. Wall Street trading floors report mounting concern about Treasury market functioning without the usual flow of economic indicators, while gold's surge above $3,800 reflects safe-haven demand as investors navigate governance risks in the world's largest economy. Trump and Democratic leaders failed to reach breakthrough after weekend meetings, with the Democrats citing that the bill will make healthcare less affordable.

Bank of Japan Signals Imminent Rate Hike as Dovish Members Turn Hawkish | Links: [4], [5], [6]

The Bank of Japan's most dovish board member delivered the ultimate policy U-turn. Junko Noguchi declared the need for rate increases is rising "more than ever," according to meeting minutes that reveal intense internal debate over near-term hikes. Markets now price a 60% probability of October action, marking a dramatic hawkish shift that sent shockwaves through the massive global carry trade funded by ultra-cheap yen. Japan's two-year bond auction posted the weakest demand since 2009, signalling investors are already repositioning for higher rates despite factory output declining for the second consecutive month and retail sales posting their first drop in 42 months. The yen's strengthening on rate hike expectations threatens to unwind carry trades that have funded risk asset purchases worldwide, creating potential liquidity pressure across global markets.

Trump Escalates Trade War with New Tariffs on Movies, Lumber, and Semiconductors | Links: [7], [8]

Trump announced 100% tariffs on foreign-made movies and demanded Taiwan slash its US chip production share to 50%, marking an unprecedented escalation into cultural content and strategic technology sectors. The entertainment tariff represents extraordinary government intervention in cultural markets, while the semiconductor ultimatum threatens Taiwan's pivotal role in global chip supply chains at a moment when US-China tech tensions are already reshaping industry dynamics. Commerce Secretary also imposed 10% tariffs on lumber imports, potentially exacerbating construction costs amid persistent housing affordability concerns. These sector-specific measures demonstrate a more surgical approach than broad-based trade wars, creating complex supply chain disruptions that extend far beyond traditional manufacturing into entertainment, construction, and the strategic semiconductor industry that underpins modern technology infrastructure.

China Manufacturing Slump Extends to Six Months Despite Conflicting Signals | Links: [9], [10], [11]

China's official manufacturing PMI remained in contractionary territory for the sixth consecutive month at 49.8, the longest decline since 2019, yet private sector data painted the opposite picture with factory activity growing at its fastest pace since March. The divergent readings complicate global managers' assessment of the world's second-largest economy just as Chinese stocks post their best monthly run since 2018, driven by AI optimism and policy support expectations. Industrial profits rebounded 20.4% in August after three months of declines, adding to conflicting economic narratives that leave commodity markets and supply chain strategists struggling to gauge China's true trajectory. This data uncertainty comes at a critical moment when global growth projections and emerging market allocations depend heavily on accurate Chinese economic assessment.

SWIFT Blockchain Revolution and Nuclear AI Boom Signal Infrastructure Transformation | Links: [12], [13], [14]

SWIFT's collaboration with over 30 global banks on blockchain-based payments represents the most significant transformation of cross-border financial infrastructure in decades, with Citigroup among major institutions participating in trials that could fundamentally challenge stablecoin dominance. The US nuclear sector faces a projected $350 billion investment boom as AI data centres demand massive power generation, with small modular reactors emerging as the preferred solution for both climate transition and computing infrastructure needs. Goldman Sachs upgraded global equities to overweight with a 6,800 S&P 500 target while simultaneously downgrading credit to underweight, signalling major cross-asset rotation as traditional banking infrastructure, nuclear technology, and risk asset allocation all undergo structural shifts that could reshape portfolio construction for the next decade.

| Dow Jones Industrial Average | --▲ +0.02% |

| S&P 500 | --▼ -0.01% |

| Hang Seng Index | --▲ +1.14% |

| FTSE 100 | --▲ +0.16% |

| CAC 40 | --▼ -0.23% |

| DAX 40 | --▼ -0.38% |

| Euro Stoxx 50 | --▼ -0.14% |

| Nasdaq Composite | --▼ -0.06% |

| Nasdaq-100 | --▼ -0.07% |

| Nikkei 225 | --▼ -0.15% |

| S&P/ASX 200 | --▲ +0.85% |

| Shanghai Composite | --▲ +0.90% |

| S&P 500 E-mini | 6710.25-3.25▼ -0.05% |

| Nasdaq-100 | 24829.80-8.00▼ -0.03% |

| FTSE 100 Index | 9349.00-11.50▼ -0.12% |

| EURO STOXX 50 | 5522.00-8.00▼ -0.14% |

| WTI Crude Oil | 63.15-0.30▼ -0.47% |

| Gold (COMEX) | 3895.90+40.70▲ +1.06% |

| Copper (COMEX) | 4.90+0.01▲ +0.19% |

| US 10-Year Treasury | 112.55+0.03▲ +0.03% |

| UK Long Gilt (10Y) | 117.81+0.02▲ +0.02% |

| German Bund (10Y) | 128.64+0.04▲ +0.03% |

| Italian BTP (10Y) | 119.79+0.33▲ +0.28% |

| US Dollar Index | 97.56-0.07▼ -0.07% |

| VIX Volatility | 17.81+0.06▲ +0.36% |

| SONIA 3M Interest Rate | 96.12+0.00▲ +0.00% |

• French Inflation Rate YoY Prel at 07:45 BST - Forecast: 1.3% vs Previous: 0.9% - Rising inflation expectations could influence ECB policy stance and euro strength ahead of December meeting.

• Italian Inflation Rate YoY Prel at 10:00 BST - Forecast: 1.7% vs Previous: 1.6% - Persistent inflation acceleration may support ECB hawkish positioning and impact Italian bond yields.

• German Inflation Rate YoY Prel at 13:00 BST - Forecast: 2.3% vs Previous: 2.2% - Europe's largest economy maintaining inflation above ECB target reinforces expectations for cautious monetary easing.

• US JOLTs Job Openings at 15:00 BST - Forecast: 7.1M vs Previous: 7.181M - Labour market cooling indicators could influence Fed dovish pivot expectations and dollar weakness.

• Japanese Tankan Large Manufacturers Index at 00:50 BST (Wednesday) - Forecast: 15.0 vs Previous: 13.0 - Corporate sentiment improvement may support yen strength and influence BoJ policy normalisation timeline.

• Close Brothers Group plc (CBG) at 13:00 BST [Pre-Market] - Est: TBD vs Prev: $0.38 - UK specialty finance results could signal broader lending market conditions amid interest rate environment changes.

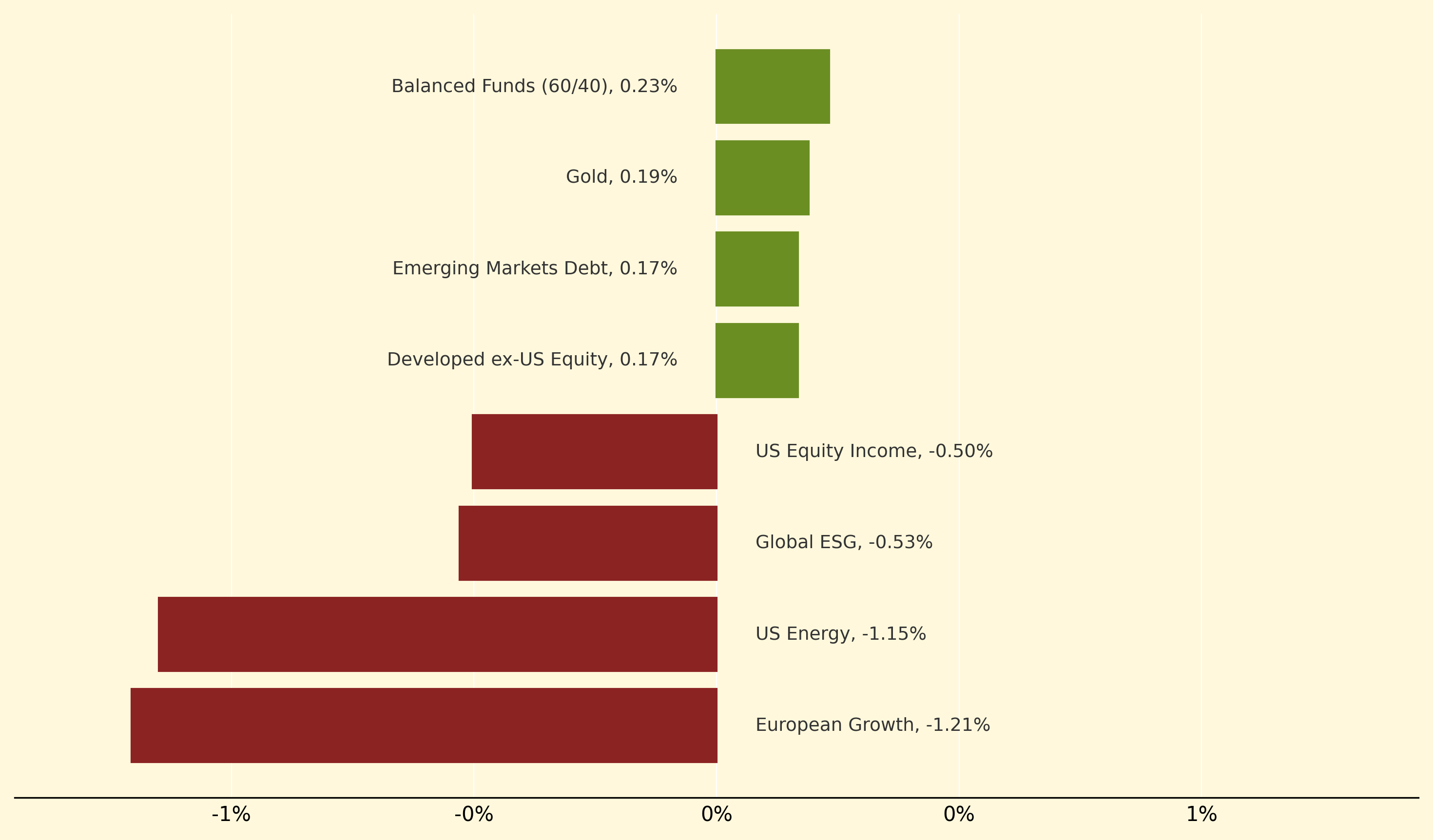

Balanced Funds (60/40) led modest gains with a 0.23% advance, benefiting from defensive positioning amid government shutdown uncertainties that drove gold 0.19% higher to record levels above $3,800. Emerging Markets Debt (+0.17%) and Developed ex-US Equity (+0.17%) also posted solid returns as investors sought diversification away from US political risks, while US Healthcare climbed 0.16% on defensive sector rotation.

Conversely, European Growth suffered the day's steepest decline at -1.21%, weighed down by broader European economic concerns and potential spillover effects from US governance instability. US Energy fell -1.15% as oil prices dipped on supply surplus concerns and OPEC+ expansion plans, while Global ESG (-0.53%) and US Equity Income (-0.50%) underperformed as investors rotated away from dividend-focused strategies amid the uncertain policy environment.

Carry trade: A strategy where investors borrow in low-yielding currencies to invest in higher-yielding assets, creating massive cross-border capital flows that can unwind rapidly when interest rate differentials narrow, potentially triggering global liquidity crunches.

Thanks for reading Morning Fill. Have a great day!

Ollie and Harry