Global Equity Funds Hit by Largest Outflows Since 2020 Amid Record Market Highs | Links: [1], [2], [3]

Investors extracted $38.66 billion from global equity funds in their largest weekly withdrawal since 2020, even as markets achieved consecutive record highs. US equity funds absorbed the heaviest damage with $43 billion in redemptions as the S&P 500 trades in the 99th percentile of valuations, triggering widespread profit-taking activity. Technology sectors led the retreat with almost $3 billion in outflows, whilst trading volumes surged to their highest levels since April. Rather than retail panic, this represents institutional repositioning, with money managers rotating $7 billion into fixed income securities. The magnitude of selling at market peaks indicates professional investors are securing gains rather than pursuing additional upside potential.

Central Bank Policy Divergence Widens as Fed Eases While Others Hold Steady | Links: [4], [5], [6]

The Federal Reserve's resumed rate cuts have created a substantial policy gap with other major central banks, generating fresh tensions across currency markets. Fed Governor Miran now advocates aggressive 50 basis point reductions, projecting deeper cuts than previously signalled. Meanwhile, the ECB confronts internal division over December policy, with some officials advocating cuts to reach 2% inflation safely whilst others maintain the bank has achieved "good equilibrium" requiring no further accommodation. China's independence from Fed policy persists for a fourth consecutive month with unchanged rates, marking a notable departure from historical correlation patterns. This divergence creates cross-currency opportunities as the dollar weakens despite domestic easing, indicating underlying economic concerns that rate cuts alone may not resolve.

France Replaces Italy as Europe's Primary Fiscal Risk as Ratings Diverge | Links: [7], [8], [9]

European sovereign risk has undergone a dramatic realignment, with France emerging as the continent's primary fiscal concern whilst Italy received its first Fitch upgrade since 2021 to BBB+. This role reversal reflects successful fiscal rehabilitation under Prime Minister Meloni for Italy, even as France's trajectory deteriorates with active downgrades to A+. European sovereign ratings are converging at their tightest levels since the debt crisis, with upgrades for Spain and Portugal accompanying France's decline. This shift represents a fundamental change in eurozone credit risk, particularly significant given France's high foreign ownership of government debt. Poland also faced pressure with a Moody's outlook cut to negative, driven by weaker fiscal prospects and political gridlock stemming from the Russia-Ukraine conflict.

Bank of Japan Signals Major Policy Shift with $250bn ETF Divestment Plan | Links: [10], [11], [12]

The Bank of Japan announced plans to divest $250 billion in ETFs and Japanese Real Estate Investment Trusts (JREITs) with a book value of ¥330 billion ($2.2 billion) annually, or ¥620 billion ($4.2 billion) at market prices. The announcement initially triggered Japanese stock sell-offs amid concerns over reduced market support, though markets recovered as investors focused on the gradual implementation timeline. Governor Ueda faces a divided board with two members dissenting for immediate rate hikes, indicating growing momentum for policy normalisation. The move coincides with Japan's LDP leadership race, where all five contenders support BOJ rate hike strategies, suggesting policy continuity regardless of outcome. This divestment establishes precedent for other central banks holding significant market positions and forces Japanese equity markets to adapt without central bank support.

Warren Buffett Exits China's BYD After 20x Returns While Boosting Japan Exposure | Links: [13], [14]

Berkshire Hathaway completely divested its 17-year BYD investment after generating 20x returns, whilst simultaneously increasing stakes in Japanese trading house Mitsui in a stark geographic reallocation. The Oracle of Omaha's pivot from China toward Japan comes as international funds reduce Chinese bond holdings to three-year lows, suggesting broader institutional withdrawal from China exposure. Buffett's timing appears prescient given escalating US-China trade tensions and represents one of his most significant geographic strategy shifts in recent years. The simultaneous exit and entry delivers a clear signal about relative regional attractiveness, with Japanese trading houses gaining credibility from the Buffett endorsement whilst Chinese EV and emerging market sentiment faces headwinds. These moves underscore how even long-term value investors are reassessing geographic allocations in an increasingly fragmented global economy.

| Dow Jones Industrial Average | --▲ +0.23% |

| S&P 500 | --▲ +0.26% |

| Hang Seng Index | --▼ -0.14% |

| FTSE 100 | --▼ -0.12% |

| CAC 40 | --▼ -0.25% |

| DAX 40 | --▼ -0.35% |

| Euro Stoxx 50 | --▼ -0.02% |

| Nasdaq Composite | --▲ +0.34% |

| Nasdaq-100 | --▲ +0.40% |

| Nikkei 225 | --▼ -1.29% |

| S&P/ASX 200 | --▲ +0.32% |

| Shanghai Composite | --▼ -0.27% |

| S&P 500 E-mini | 6716.50-6.00▼ -0.09% |

| Nasdaq-100 | 24850.80-15.50▼ -0.06% |

| FTSE 100 Index | 9268.50-8.50▼ -0.09% |

| EURO STOXX 50 | 5477.00+1.00▲ +0.02% |

| WTI Crude Oil | 62.85+0.45▲ +0.72% |

| Gold (COMEX) | 3731.80+26.00▲ +0.70% |

| Copper (COMEX) | 4.64+0.01▲ +0.17% |

| US 10-Year Treasury | 112.73-0.02▼ -0.01% |

| UK Long Gilt (10Y) | 117.61-0.08▼ -0.07% |

| German Bund (10Y) | 128.04-0.14▼ -0.11% |

| Italian BTP (10Y) | 119.73-0.23▼ -0.19% |

| US Dollar Index | 97.42+0.15▲ +0.15% |

| VIX Volatility | 17.75+0.03▲ +0.18% |

| SONIA 3M Interest Rate | 96.13-0.01▼ -0.01% |

• German HCOB Manufacturing PMI Flash on Tuesday at 08:30 BST - Forecast: 50.1 vs Previous: 49.8 - Key gauge of eurozone's largest economy potentially returning to expansion territory.

• UK S&P Global Manufacturing PMI Flash on Tuesday at 09:30 BST - Forecast: 47.2 vs Previous: 47.0 - Critical indicator of UK manufacturing sector health amid ongoing economic uncertainty.

• UK S&P Global Services PMI Flash on Tuesday at 09:30 BST - Forecast: 53.6 vs Previous: 54.2 - Services sector dominates UK economy, making this crucial for sterling and gilt markets.

• US Fed Chair Powell Speech on Tuesday at 17:35 BST - Powell's remarks will be closely watched for guidance on future rate cuts following recent policy pivot.

• German Ifo Business Climate on Wednesday at 09:00 BST - Forecast: 89.5 vs Previous: 89.0 - Leading indicator of German business sentiment and eurozone economic momentum.

• German GfK Consumer Confidence on Thursday at 07:00 BST - Forecast: -23.0 vs Previous: -23.6 - Consumer spending drives economic growth, making this vital for euro direction.

• US GDP Growth Rate QoQ Final on Thursday at 13:30 BST - Forecast: 3.3% vs Previous: -0.5% - Final reading will confirm strength of US economic expansion supporting dollar.

• US Durable Goods Orders MoM on Thursday at 13:30 BST - Forecast: -0.4% vs Previous: -2.8% - Business investment indicator crucial for Fed policy outlook and industrial sector performance.

• US Personal Spending MoM on Friday at 13:30 BST - Forecast: 0.5% vs Previous: 0.5% - Consumer spending drives 70% of US economy, critical for growth and inflation outlook.

• US Core PCE Price Index MoM on Friday at 13:30 BST - Forecast: 0.2% vs Previous: 0.3% - Fed's preferred inflation gauge will influence rate cut expectations and dollar strength.

• H&M Hennes & Mauritz AB Class B (HM_B) on Thursday at 07:00 BST Pre-Market - $25.9B - Europe's second-largest fashion retailer will provide insights into consumer spending trends and fast fashion sector health amid challenging retail conditions.

• Accenture plc (ACN) on Thursday at 14:30 BST During-Hours - $149.3B - Global consulting and technology services giant's results will signal corporate IT spending trends and digital transformation demand across industries.

• Costco Wholesale Corporation (COST) on Thursday at 21:15 BST During-Hours - $421.8B - Membership warehouse club's performance will indicate consumer resilience and retail sector strength, particularly relevant for inflation and spending patterns.

• Jabil Inc. (JBL) on Thursday at 12:45 BST Pre-Market - $24.1B - Electronics manufacturing services provider's results will reflect global supply chain conditions and technology hardware demand trends.

• Oracle Corporation Japan (4716) on Thursday at 13:00 BST Pre-Market - $14.1B - Regional performance of the database software giant will provide insights into enterprise technology spending in Asia-Pacific markets.

• Zegona Communications Plc (ZEG) on Friday at 13:00 BST Pre-Market - $12.3B - London-listed telecommunications investment company's results will indicate European telecom sector investment opportunities and performance.

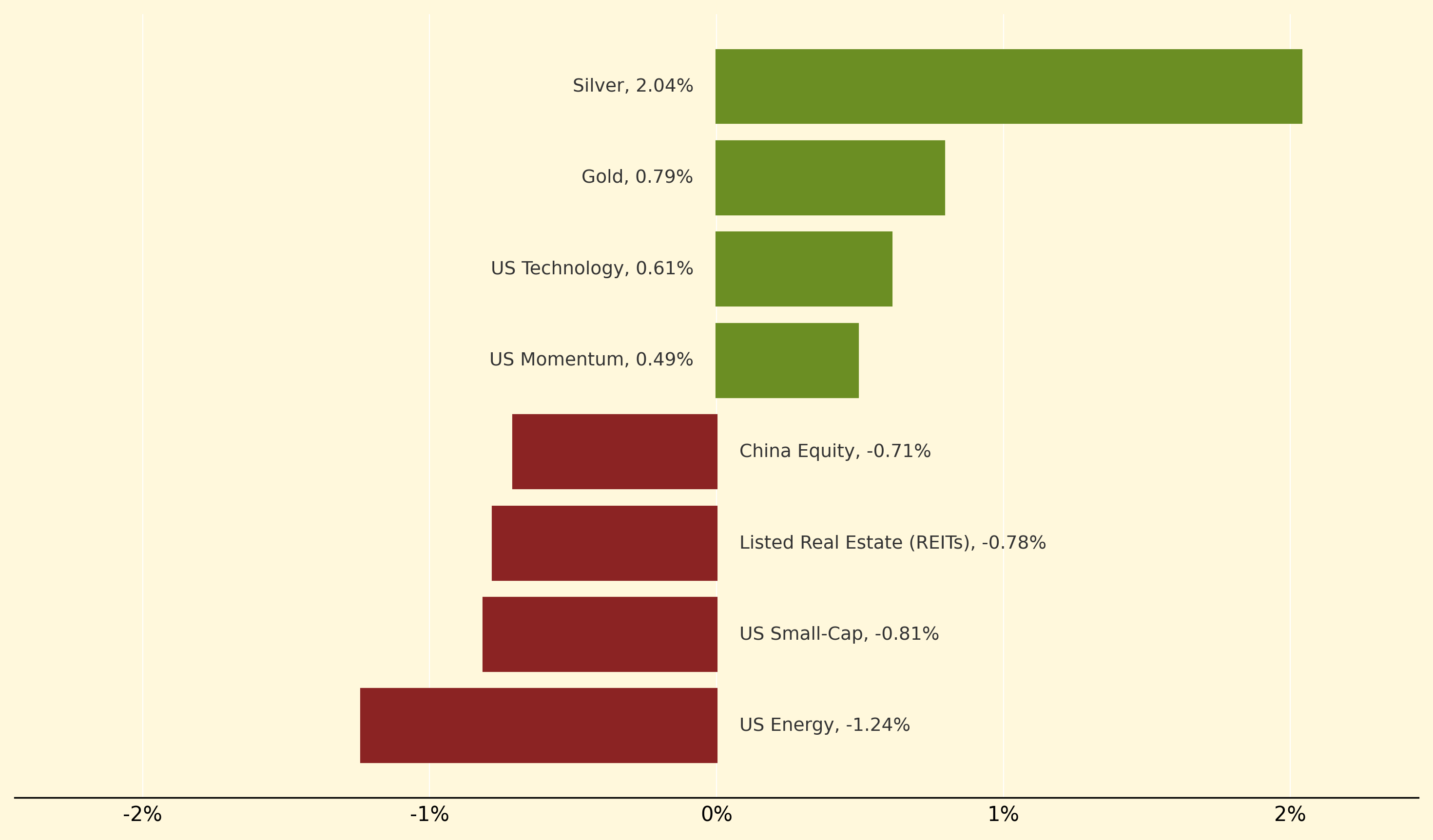

Silver surged 2.04% to lead precious metals higher, as gold also gained 0.79% amid expectations of further Fed easing and dollar weakness. US Technology advanced 0.61% despite broader institutional profit-taking, whilst US Momentum and Large-Cap Growth posted modest gains of 0.49% and 0.39% respectively, benefiting from continued record-high momentum despite the $43.19 billion in US equity outflows.

Conversely, US Energy dropped 1.24% as oil prices faced pressure from robust supply conditions despite geopolitical tensions. US Small-Cap fell 0.81% whilst REITs declined 0.78%, both sectors struggling with the rotation toward fixed income as investors moved $7.33 billion into bonds. China Equity lagged with a 0.71% decline, reflecting continued institutional retreat as international funds cut Chinese bond holdings to three-year lows following Buffett's complete BYD exit.

ETF unwinding: The systematic disposal of exchange-traded fund holdings by central banks, representing a retreat from unconventional monetary policy where authorities directly supported equity markets through large-scale purchases, requiring careful timing to avoid destabilising markets.

Thanks for reading Morning Fill. Have a great day!

Ollie and Harry