Global Markets Rally as Fed Rate Cut 'Locked In' Despite Hot US Inflation | Links: [1], [2], [3]

US markets hit fresh records and Asian stocks surged to near 25-year highs as traders shrugged off August's hotter-than-expected inflation print to bet on Fed easing next week. Consumer prices rose 2.9% annually versus the 2.7% forecast, with monthly gains of 0.2%, but core CPI met expectations and unemployment claims jumped alongside the data. Markets are convinced Jerome Powell's recent dovish commentary indicates the Fed will prioritise labour market weakness over sticky inflation, driving cross-asset momentum into risk assets. Japanese tech stocks extended their rally for a third consecutive day whilst gold pushed toward inflation-adjusted records from 1980, as dollar weakness supported commodities and emerging markets across the board.

Trump Battles for Fed Control as Cook Removal Bid Escalates | Links: [4], [5], [6]

The Trump administration is moving aggressively to remove Fed Governor Lisa Cook, asking courts to lift the ruling that blocked her dismissal whilst Cook warns of potential voting disruptions. This unprecedented challenge to Federal Reserve independence comes as Treasury Secretary Bessent continues meeting with potential Fed Chair candidates including Warsh, Lindsey, and Bullard. The administration's broader assault on central bank autonomy represents a fundamental threat to institutional credibility built over decades, creating constitutional tensions between executive power and monetary policy independence. Cook's resistance and the legal battle highlight systemic risks for USD-denominated assets and could trigger volatility spikes if the challenges succeed, fundamentally altering global dollar confidence and central banking credibility worldwide.

ECB Signals End of Easing Cycle as Policy Divergence Widens | Links: [7], [8], [9]

The European Central Bank held rates unchanged at 2% and traders are now betting it has finished cutting entirely. ECB officials including Cyprus's Patsalides stated the bank can deliver 2% inflation without further cuts, whilst markets have ruled out additional easing despite inflation undershooting targets. JPMorgan pushed back its ECB cut forecast to December following the policy meeting, reflecting Europe's more resilient economic performance compared to US labour market weakness. This marks a stark cross-Atlantic monetary policy divergence not seen since the financial crisis, likely strengthening the euro against the dollar whilst supporting European bond yields and potentially tightening credit spreads as policy paths fundamentally separate.

Gold Surpasses 1980 Inflation-Adjusted Record with 40% Annual Gains | Links: [10]

Gold has broken through its inflation-adjusted record high from 1980, posting nearly 40% gains for the year driven by Fed rate cut expectations and institutional ETF inflows. The precious metal is set for its fourth consecutive weekly rise as positioning shifts toward hard assets amid monetary policy uncertainty and central bank credibility concerns. The breakthrough past the 1980 peak represents a significant technical milestone that removes key resistance levels and validates the broader commodity reflation thesis, with silver simultaneously surging to 2011 levels. Combined with the Fed independence battle and currency debasement fears, precious metals are displaying deep institutional concerns about the stability of major central banking regimes and the long-term purchasing power of fiat currencies.

SK Hynix Soars to 25-Year Highs on AI Memory Breakthrough | Links: [11]

SK Hynix shares hit record highs after announcing a breakthrough in high-end AI memory chips, with the stock now worth $170 billion following 90% annual gains. The memory chip breakthrough specifically targets high-bandwidth memory needed for advanced AI training and inference, positioning SK Hynix as a critical enabler of the next phase of AI development beyond software applications. This hardware advancement demonstrates how AI infrastructure spending continues accelerating despite broader market volatility, with the tech rally broadening from software into hardware components. The milestone reflects continued strength in the AI semiconductor cycle and validates supply chain positioning around AI hardware as increasingly strategic, supporting the thesis that infrastructure build-out will drive the sector's next growth phase.

| Dow Jones Industrial Average | --▲ +1.16% |

| S&P 500 | --▲ +0.50% |

| Hang Seng Index | --▲ +0.38% |

| FTSE 100 | --▲ +0.78% |

| CAC 40 | --▲ +0.54% |

| DAX 40 | --▲ +0.21% |

| Euro Stoxx 50 | --▲ +0.45% |

| Nasdaq Composite | --▲ +0.30% |

| Nasdaq-100 | --▲ +0.15% |

| Nikkei 225 | --▲ +1.13% |

| S&P/ASX 200 | --▲ +0.00% |

| Shanghai Composite | --▲ +1.82% |

| S&P 500 E-mini | 6592.00-- |

| Nasdaq-100 Futures | 24024.20-- |

| FTSE 100 Index Futures | 9327.50-- |

| EURO STOXX 50 Futures | 5396.00-- |

| US Dollar Index Futures | 97.24-- |

| WTI Crude Oil | 61.86-- |

| Gold (COMEX) | 3694.90-- |

| US 10-Year Treasury Note Futures | 113.47-- |

| UK Long Gilt Futures (10Y) | 117.98-- |

| German Bund Futures (10Y) | 129.01-- |

| VIX Volatility Futures | 18.00-- |

| Italian BTP Futures (10Y) | 120.42-- |

| SONIA 3M Interest Rate Futures | 96.04-- |

| Copper (COMEX) | 4.68-- |

• UK GDP MoM at 07:00 BST - Forecast: 0.0% vs Previous: 0.4% - Key indicator of UK economic momentum that will influence BoE policy expectations and GBP direction.

• UK Industrial Production MoM at 07:00 BST - Forecast: 0.0% vs Previous: 0.7% - Manufacturing slowdown indicators could weigh on GBP and UK equity sectors.

• UK Manufacturing Production MoM at 07:00 BST - Forecast: 0.0% vs Previous: 0.5% - Decline from previous month may reinforce concerns about UK industrial competitiveness.

• UK Goods Trade Balance at 07:00 BST - Forecast: -£21.75B vs Previous: -£22.16B - Modest improvement expected but persistent deficit remains a structural GBP headwind.

• China New Yuan Loans at 12:30 BST - Forecast: ¥800.0B vs Previous: -¥549.0B - Sharp rebound in credit growth could indicate policy stimulus effectiveness and support commodity currencies.

• US Michigan Consumer Sentiment Prel at 15:00 BST - Forecast: 58.0 vs Previous: 58.2 - Consumer confidence levels will influence Fed policy expectations and USD momentum ahead of key decisions.

• Virbac SA (VIRP) at 16:30 GMT [During-Hours] - Est: N/A vs Prev: N/A - French veterinary pharmaceutical leader's results could signal health trends in the European animal health sector.

• Eco World Development Group Bhd. (ECOWLD) at 13:00 GMT [Pre-Market] - Est: N/A vs Prev: $0.01 - Malaysian property developer's performance may reflect broader Southeast Asian real estate market conditions.

• Token Corporation (1766) at 13:00 GMT [Pre-Market] - Est: N/A vs Prev: $2.25 - Japanese construction company's results could indicate infrastructure spending trends in the region.

• Kura Sushi, Inc. (2695) at 13:00 GMT [Pre-Market] - Est: N/A vs Prev: $0.18 - Restaurant chain's performance may reflect consumer spending patterns in Japan's service sector.

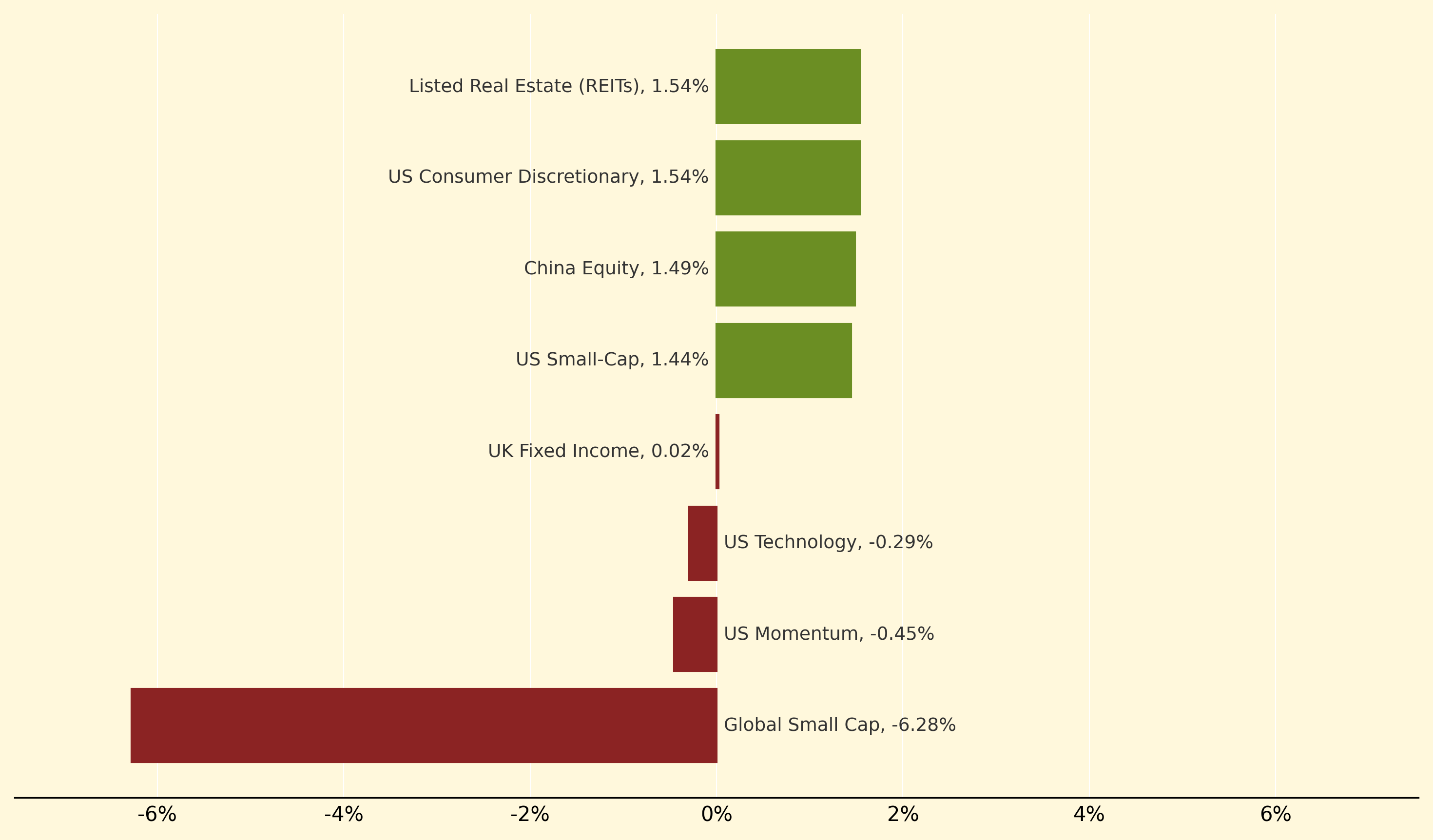

Listed Real Estate (REITs) and US Consumer Discretionary both surged 1.54%, leading the winners as Fed rate cut expectations solidified despite hotter-than-expected inflation data. China Equity gained 1.49% amid broader emerging market strength, whilst US Small-Cap advanced 1.44% as traders positioned for lower rates benefiting domestic-focused companies.

Global Small Cap suffered an extraordinary decline of 6.28%, representing an unusually severe selloff that contrasts sharply with the broader risk-on sentiment. US Momentum fell 0.45% and US Technology dropped 0.29%, indicating some profit-taking in previously high-flying sectors despite the overall market rally driven by Fed easing bets.

Cross-Atlantic monetary policy divergence: The phenomenon where major central banks pursue fundamentally different interest rate trajectories, creating currency volatility and capital flow disruptions as investors arbitrage the policy differentials between economic blocs.

Thanks for reading Morning Fill. Have a great day!

Ollie and Harry