Global Bond Selloff Deepens as Fiscal Concerns Grip Major Economies | Links: [1], [2], [3]

Government bond markets worldwide face mounting pressure as investors grow increasingly nervous about fiscal sustainability. US 30-year Treasury yields have climbed to multi-decade highs, while European and Japanese bonds face similar stress from concerns about ballooning government debt and spending trajectories. Japan is confronting particularly acute challenges, with long-term JGB yields surging to levels not seen since 1999 just as the country prepares a record ¥122.45 trillion ($831bn) budget request. The sell-off reflects deeper unease about whether central banks can effectively manage monetary policy and government financing needs simultaneously.

Trump Escalates Tariff Battle with Supreme Court Appeal and Trade Deal Ultimatum | Links: [4], [5], [6]

President Trump has dramatically raised the stakes in his tariff fight by asking the Supreme Court to quickly uphold his global duties while simultaneously threatening to terminate major trade agreements with the EU, Japan, and South Korea if the tariffs are struck down. This represents a critical escalation beyond previous appeals court challenges, continuing the uncertainty for global supply chains managing over $2 trillion in annual trade flows. Treasury markets already price in potential tariff revenues to help constrain government borrowing, reflecting expectations that the regime will survive legal challenges despite fierce opposition from trading partners.

Bank of England Signals End to Rate Cutting Cycle Amid Budget Uncertainty | Links: [7], [8], [9]

Bank of England Governor Andrew Bailey has cast significant doubt on further rate cuts, indicating the current easing cycle nears its end with particular scepticism about a November reduction. This hawkish pivot comes as Chancellor Rachel Reeves faces mounting pressure from bond investors ahead of the Autumn Budget on November 26, with markets demanding credible fiscal discipline amid global debt concerns. Bailey has also criticised Trump's 'dangerous' threats against Federal Reserve independence, highlighting growing concerns about central bank autonomy worldwide. The combination of tighter monetary policy and fiscal uncertainty creates a challenging backdrop for UK assets, though sterling may benefit from rate differentials if the Fed continues cutting while the BoE holds steady.

Alphabet Dodges Breakup in Antitrust Victory, Adding $230 Billion in Value | Links: [10], [11]

Alphabet shares surged 6% after a US court ruling avoided the Chrome browser breakup while imposing data-sharing requirements instead, delivering a $230 billion boost to market value that reflects reduced regulatory risk for big tech. The ruling establishes crucial precedent for how courts handle big tech monopoly cases, favouring operational restrictions over structural breakups and providing breathing room for technology giants facing regulatory scrutiny. Washington signalled continued antitrust enforcement despite this setback, but the decision marks a significant victory that could reshape enforcement approaches across the sector. The data-sharing requirements may still alter competitive dynamics in search and AI markets, though investors clearly view this outcome as far preferable to corporate breakup scenarios.

China Markets Cool as Regulators Eye Speculation Curbs After $1.2 Trillion Rally | Links: [12], [13], [14]

Chinese regulators consider measures to cool stock market speculation following a massive $1.2 trillion equity rally since August, signalling policy intervention risk in the world's second-largest economy. Despite initial hopes for a virtuous feedback loop between stock and yuan strength, authorities appear increasingly concerned about excessive speculation and market froth that could undermine stability. The cooling measures coincide with signs that China's white-hot economic momentum may be decelerating, with BYD cutting its 2025 sales target by 16% as even the electric vehicle boom shows signs of moderation. Asian markets more broadly have pared gains as Chinese weakness spreads, creating divergence from Fed easing optimism that had initially supported regional risk sentiment and raising questions about whether Chinese stimulus can sustain global growth expectations.

| Dow Jones Industrial Average | --▼ -0.08% |

| S&P 500 | --▲ +0.04% |

| Hang Seng Index | --▼ -1.24% |

| FTSE 100 | --▲ +0.67% |

| CAC 40 | --▲ +0.26% |

| DAX 40 | --▼ -0.05% |

• Canadian Balance of Trade at 13:30 BST - Previous: -$5.86B - Key indicator for CAD strength as trade balance improvements typically support currency appreciation.

• US ISM Services PMI at 15:00 BST - Previous: 50.1 - Critical gauge of US service sector health that could influence Fed policy expectations and USD direction.

• US ADP Employment Change at 13:15 BST - Previous: 104.0K - Leading indicator for Friday's official jobs report that shapes Fed rate cut probabilities and market sentiment.

• EU Retail Sales MoM at 10:00 BST - Previous: 0.3% - Reflects eurozone consumer demand strength, impacting ECB policy outlook and EUR positioning.

• US Balance of Trade at 13:30 BST - Previous: -$60.2B - Trade deficit changes affect USD sentiment and provide insights into US economic competitiveness.

• US Initial Jobless Claims at 13:30 BST - Weekly employment health check that influences Fed policy expectations and broader risk sentiment in equity markets.

• Sun Hung Kai Properties Limited (SUHJF) During-Hours - Est: TBD vs Prev: $0.46 - Hong Kong property giant's results could signal broader Asian real estate market health amid ongoing regional headwinds.

• CVC Capital Partners plc (CVC) During-Hours - Est: TBD vs Prev: $0.45 - Private equity leader's earnings may reflect dealmaking environment and portfolio company performance in current market conditions.

• Copart, Inc. (CPRT) During-Hours - Est: TBD vs Prev: $0.42 - Auto auction platform's results will indicate used vehicle market strength and supply chain recovery trends.

• lululemon athletica inc. (LULU) During-Hours - Est: TBD vs Prev: $2.60 - Athletic apparel leader's performance could signal consumer spending resilience in premium lifestyle categories.

• DocuSign, Inc. (DOCU) During-Hours - Est: TBD vs Prev: $0.90 - Digital transformation software company's guidance will indicate enterprise software demand and remote work technology adoption.

• Broadcom Inc. (AVGO) During-Hours - Est: TBD vs Prev: $1.58 - Mega-cap semiconductor giant's AI chip demand and enterprise software performance will drive broader tech sector sentiment.

• Samsara Inc. (IOT) During-Hours - Est: TBD vs Prev: $0.11 - IoT platform company's results may indicate enterprise digitalization spending and fleet management technology adoption.

• Guidewire Software, Inc. (GWRE) During-Hours - Est: TBD vs Prev: $0.88 - Insurance software specialist's performance will reflect property & casualty industry technology investment trends.

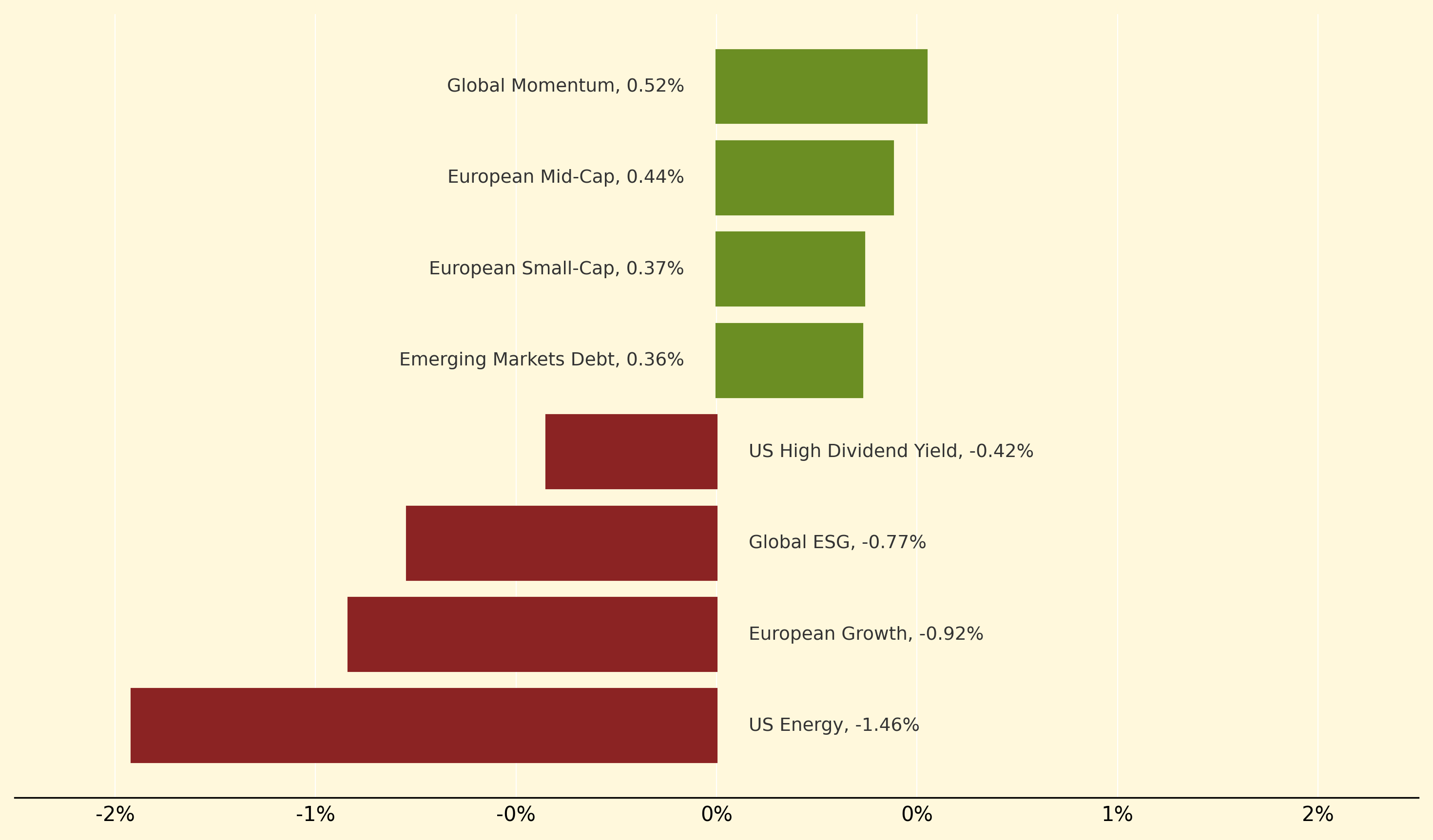

Global Momentum led yesterday's gains, climbing 0.52% as momentum strategies benefited from continued market optimism despite fiscal uncertainties. European Mid-Cap and Small-Cap strategies also performed well, advancing 0.44% and 0.37% respectively, indicating regional equity resilience amid the broader bond market pressure affecting major economies.

Conversely, US Energy underperformed significantly, dropping 1.46% as oil prices declined on OPEC+ supply concerns and signs of US economic slowdown. European Growth also lagged, falling 0.92%, while Global ESG strategies declined 0.77% amid continued ESG-related divestments. Although, the sector could benefit from any momentum following the Dutch pension fund PFZW's $17 billion withdrawal from BlackRock over sustainability disagreements.

Fiscal dominance: A scenario where government debt levels become so large that monetary policy decisions are primarily driven by the need to keep borrowing costs manageable rather than achieving price stability, effectively subordinating central bank independence to fiscal financing requirements and constraining traditional monetary policy tools.

Thanks for reading Morning Fill. Have a great day!

Ollie and Harry